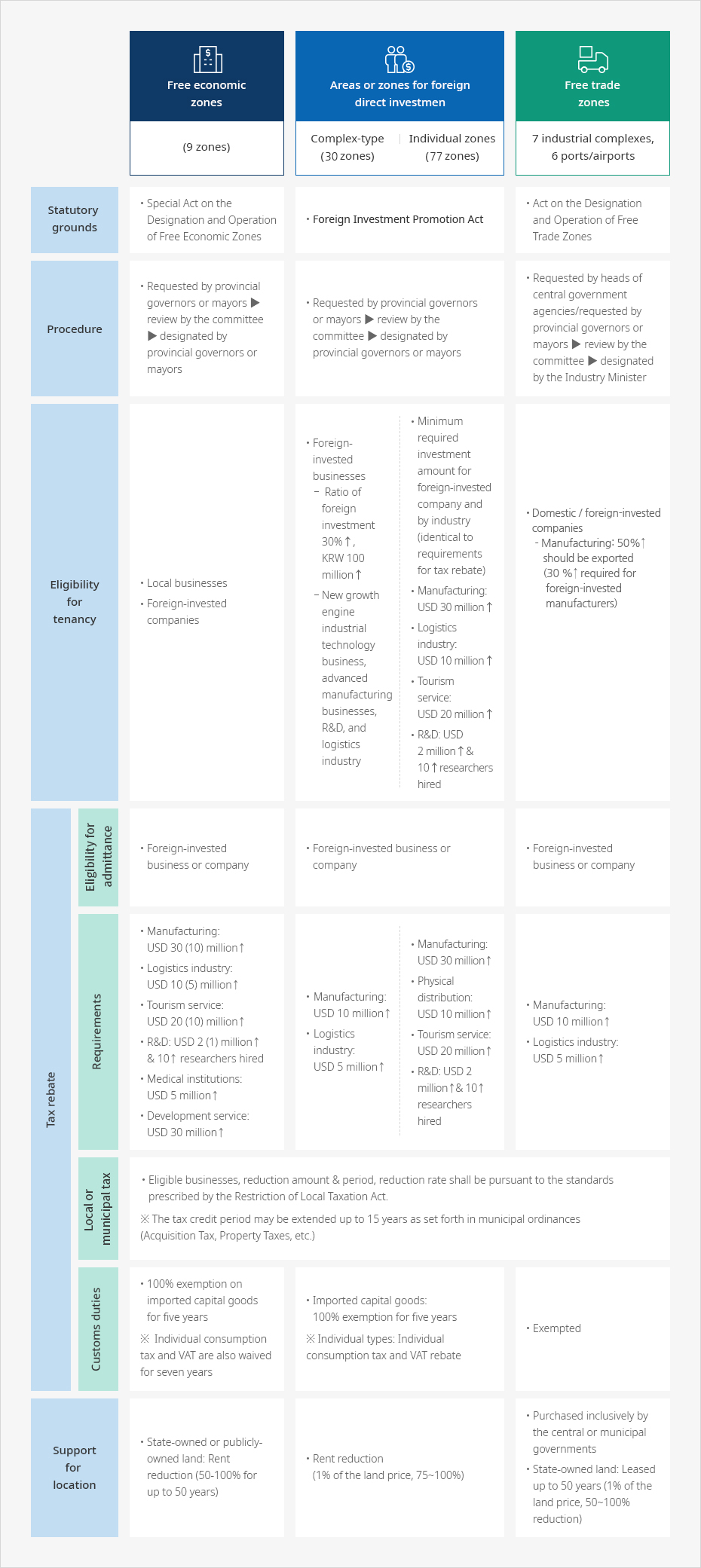

| Statutory grounds |

Special Act on the Designation and Operation of Free Economic Zones

|

Foreign Investment Promotion Act |

Act on the Designation and Operation of Free Trade Zones |

| Procedure |

- Requested by provincial governors or mayors

- review by the committee

- designated by provincial governors or mayors

|

- Requested by provincial governors or mayors

- review by the committee

- designated by provincial governors or mayors

|

- Requested by heads of central government agencies/requested

by provincial governors or mayors

- review by the committee

- designated by the Industry Minister

|

| Eligibility for tenancy |

- Local businesses

- Foreign-invested companies

|

Foreign-invested businesses

- Ratio of foreign investment 30%↑, KRW 100 million↑

- New growth engine industrial technology business, advanced

manufacturing businesses, R&D, and logistics industry

|

- Minimum required investment amount for foreign-invested

company and by industry (identical to requirements for tax

rebate)

- Manufacturing: USD 30 million↑

- Logistics industry: USD 10 million↑

- Tourism service: USD 20 million↑

- R&D: USD 2 million↑& 10↑researchers hired

|

- Domestic

- Foreign-invested companies

- Manufacturing: 50%↑ should be exported

- Wholesale business:50%↑ should be imported and

exported

- Logistics industry and business support service

|

| Tax rebate |

Eligibility for admittance |

Foreign-invested business or company |

Foreign-invested business or company |

Foreign-invested business or company |

| Requirements |

- Manufacturing: USD 30 (10) million↑

- Logistics industry: USD 10 (5) million↑

- Tourism service: USD 20 (10) million↑

- R&D: USD 2 (1) million↑ & 10↑ researchers hired

- Medical institutions: USD 5 million↑

- Development service: USD 30 million↑

|

- Manufacturing: USD 10 million↑

- Logistics industry: USD 5 million↑

|

- Manufacturing: USD 30 million↑

- Physical distribution: USD 10 million↑

- Tourism service: USD 20 million↑

- R&D: USD 2 million↑& 10↑ researchers hired

|

- Manufacturing: USD 10 million↑

- Logistics industry: USD 5 million↑

|

| Local or municipal tax |

Eligible businesses, reduction amount & period, reduction rate shall

be pursuant to the standards

prescribed by the Restriction of Local Taxation Act.

The tax credit period may be extended up to 15 years as set forth in municipal ordinances

(Acquisition Tax, Property Taxes, etc.)

|

| Customs duties |

100% exemption on imported capital goods for five years

Individual consumption tax and VAT are also waived for seven years

|

Imported capital goods: 100% exemption for five years

Individual types: Individual consumption tax and VAT rebate

|

Exempted |

| Support for location |

State-owned or publicly-owned land: Rent reduction (50-100% for up to 50 years) |

Rent reduction (1% of the land price, 75~100%) |

- Purchased inclusively by the central or municipal governments

- State-owned land: Leased up to 50 years (1% of the land price, 50~100% reduction)

|