The United Nations Statistics

Division classified countries into

two major groups: “less developed

countries (LDCs)” and

“developed countries (DCs).” This classification is based on the country’s economic

indicator, GDP and per capita income.

However, this designation received some

criticism because it implies that less developed countries are inferior to developed

countries.

However, the UN explains that the

country designations “LDCs” and “DCs”

are simply intended for statistical convenience and do not express judgment about a

member country’s economic state. A less

developed country is also called a developing country.

To name a country according to its special economic features, a new term, “an

emerging market economy” was created in

the 1980s. An emerging market refers to a

country that has some characteristics of a

developed market but does not meet the

standards of a developed market economy.

In the aftermath of the Asian financial

crises in 1998 and 1999, developing and

emerging countries began to strengthen

their policy to attract foreign direct investment (FDI). They had strongly believed

that FDI inflow was the short cut to

achieving sustainable growth.

In recent years, these countries have

learned that not only should they attract

foreign firms with advanced technology to

accelerate industrialization, but they

should also try to keep the FDI in the

country for a longer period of time. This is

why developing countries have to provide

aftercare services for foreign-invested

companies operating business in the host

country.

On that note, Korea is cited as one of

very few countries that has adopted the

Foreign Investment Ombudsman system

in 1999. This system was established by

the Foreign Investment

Promotion Act.

The Office of the

Foreign Investment Ombudsman

focuses on preventing and

settling various grievances facing foreign

investors. The team is comprised of professional specialists, including lawyers,

accountants, financial analysts and labor

counselors.

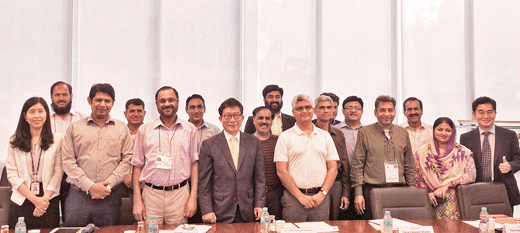

On August 25, a delegation of 14 high-

ranking officials from Pakistan visited our

office. The delegates, who wanted to learn

about the Foreign Investment Ombudsman

system, were from the Ministry of Finance

and the Department of Planning and

Development and Economic Coordination

of Presidential Office. They were amazed

to learn that foreign investors in Korea

have influence in the process of enacting

new laws and regulations related to foreign

investment.

Similarly, on August 29, another delegation

of 10 government officials from

Uzbekistan visited our office to learn about

the Korean Ombudsman system and the

benefits available in the country’s Free

Economic Zones.

In the aftermath of the global economic

recession, a new phenomenon has prevailed. Even developed countries began to

attract FDI to increase their GDP and

employment rate. They have started offering

incentives for FDI from any country,

regardless of whether it has an economy

that is developed or still developimg.

According to the OECD’s recent publication,

the inflow of FDI into developing

countries in Asia was USD

410 billion in 2012. This amount has

been on the rise

since then, recording a 5.3 percent increase

in 2013, an 8.5 percent increase in 2014

and a 15.6 percent increase in 2015. A

similar phenomenon has occurred in

developed countries. The total amount of

FDI in the European Union was USD 250

billion in 2014, increasing by 93 percent in

2015 and 14 percent in 2016. In contrast,

the total FDI inflow into the OECD and

G20 member nations in 2014 was about

USD 440 billion. The amount increased by

64 percent in 2015 and 30 percent in 2016.

The competition for FDI attraction will

continue to increase in the coming years.

So the importance of FDI inflows for

developing countries and Korea must not

be overlooked.

The Foreign Investment Ombudsman and his grievance resolution body collect and analyze information concerning problems facing foreign firms, request cooperation from relevant government agencies, propose new policies investment promotion system and carry out other necessary tasks to assist foreign-invested companies in resolving their grievances.