Tourism

- Home

- Investment Opportunities

- Industries

- Tourism

-

Global Tourism Market Trends on Track to Recovery CloseGlobal Tourism Market Trends on Track to RecoveryAccording to the United Nations World Tourism Organization (UNWTO), more than 96.066 billion tourists travelled overseas in 2022, leading to the growth of the global tourism industry and the increasing number of tourists.

Growth of the Global Tourism Market Category, Years Category ’04 ’05 ’06 ’07 ’08 ’09 ’10 ’10 ’11 ’12 ’13 ’14 ’15 ’16 ’17 ’18 ’19 ’20 No. of tourists (millions) 761 809 842 898 930 892 956 997 1,043 1,095 1,142 1,397 1,243 1,332 1,407 1,455 406 429 Tourism revenue (USD billion) 633 705 744 856 973 886 979 1,080 1,117 1,204 1,274 1,223 1,254 1,349 1,453 1,483 548 617 ※ Source: UNWTO, World Tourism Barometer

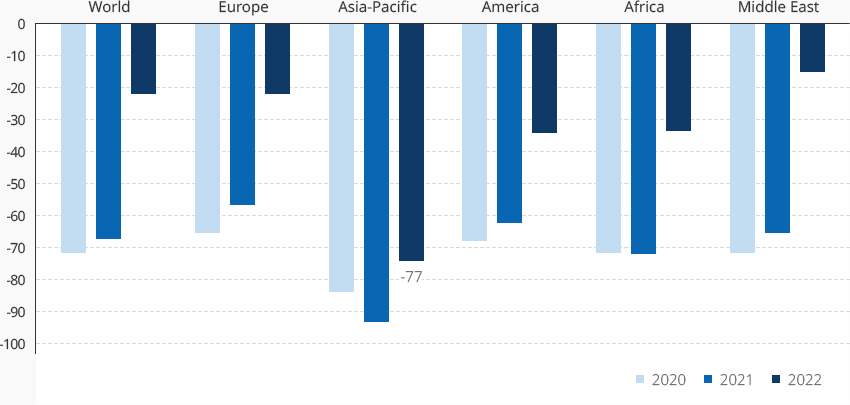

※ Note: 2021 figures are tentativeGrowth Rates of Overseas Tourists (compared to 2019) Years, world Year World Europe Asia-Pacific America Africa Middle East 2020 -72 -68 -84 -68 -73 -73 2021 -69 -59 -93 -63 -72 -66 2022 -21 -21 -77 -35 -35 -17 ※ Source: Korea Culture and Tourism InstituteThe World Travel & Tourism Council (WTTC) forecasted that the tourism industry will contribute USD 8.6 trillion to the global economy in 2022. Considering that the contribution was USD 9.2 trillion in 2019, the tourism industry is clearly returning to pre-pandemic levels. The recovery is largely led by Europe, America, and the Middle East, which account for a large share in the global tourism industry. However, Asia-Pacific’s slow recovery of having reached -77% of 2019 levels reflects China’s significant impact in the Asian region. -

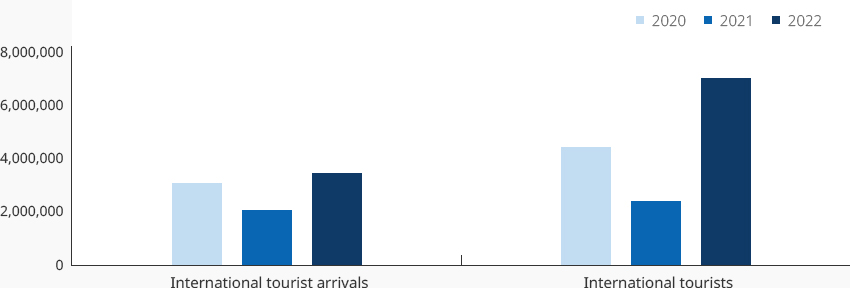

Diversification of the Korean Tourism Market OpenDiversification of the Korean Tourism MarketAn estimated 3,198,000 foreign tourists have visited Korea in 2022, showing a rebound from the impact of the pandemic. The number of tourists is expected to increase further from 2023. When asked about what the factors they have considered in choosing Korea as their tourist destination (multiple choices), most or 43.1% chose food/culinary tourism and 34.4% chose nature travel, and the answers are very similar to those of 2019.

Foreign Tourist Arrivals (Unit: thousand people)

Foreign Tourist Arrivals (Unit: thousand people)- 2018 : 15346

- 2019 : 17502

- 2020 : 2519

- 2021 : 967

- 2022 : 3198

Factors Foreign Tourists Consider when Choosing Korea as their Tourist Destination (Multiple choices)- Food/culinary tourism : 43.1

- Nature travel : 34.4

- Shopping : 33.6

- History/culture/cultural heritage tourism : 18.6

- Others : 44

※ Source: Tourism Knowledge & Information System (www.tour.go.kr), Korea Tourism Data Lab (www.datalab.vistkorea.or.kr)In 2021 in the midst of the pandemic, the main purpose of foreign tourists visiting Korea was business/professional activities (41.18%). From January 2023, however, travelling purposes were similar to those of 2019, with the majority of foreigners visiting to travel (72%), followed by business purposes (0.1%), official purposes (0.1%), study (3%), and others (24.8%).※ Source: Korea Tourism Data Lab (www.datalab.vistkorea.or.kr)Types of tourists visiting Korea have changed since the pandemic, showing a shift in factors that attract them to Korea.

※ Source: Tourism Knowledge & Information System (www.tour.go.kr), Korea Tourism Data Lab (www.datalab.vistkorea.or.kr)In 2021 in the midst of the pandemic, the main purpose of foreign tourists visiting Korea was business/professional activities (41.18%). From January 2023, however, travelling purposes were similar to those of 2019, with the majority of foreigners visiting to travel (72%), followed by business purposes (0.1%), official purposes (0.1%), study (3%), and others (24.8%).※ Source: Korea Tourism Data Lab (www.datalab.vistkorea.or.kr)Types of tourists visiting Korea have changed since the pandemic, showing a shift in factors that attract them to Korea.- * International tourist arrivals: Foreign nationals visiting Korea as tourists

- * International tourists: Arrivals + Korean nationals going overseas to travel

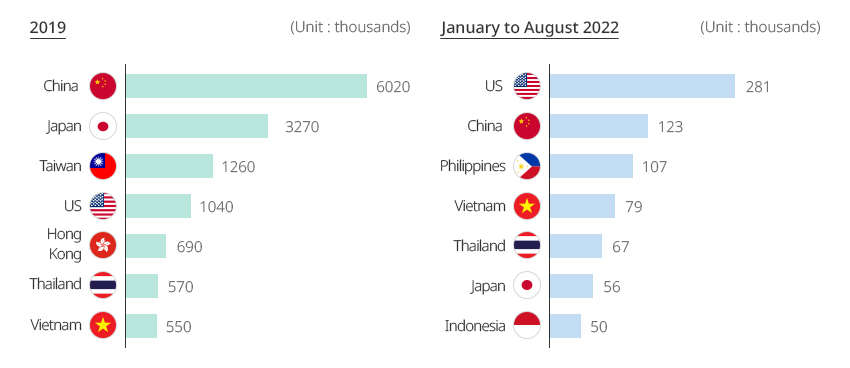

※ Source: Korea Culture and Tourism InstituteThe majority of tourists visiting Korea were from China and Japan in 2019, but in 2022, the biggest share of tourists were from the US, and the number of tourists from Southeast Asia surpassed those from China and Japan."No. of Foreign Tourists: Before and After COVID-19" 2019 (Unit : thousands)

2019 (Unit : thousands)- China 602

- Japan 327

- Taiwan 126

- US 104

- Hong Kong 69

- Thailand 57

- Vietnam 55

January to August 2022 (Unit : thousands)- US 28.1

- China 12.3

- Philippines 10.7

- Vietnam 7.9

- Thailand 6.7

- Japan 5.6

- Indonesia 5

※ Source: Korea Tourism OrganizationIn 2022, global tourism receipts reached USD 1,031 billion, returning to 69% of pre-pandemic levels, while Korea’s tourism receipts reached USD 11.8 billion in 2022, up 110% from 2021. Each foreign tourist visiting Korea spent an average of USD 3,684 in 2022, which is higher than the global average of USD 1,071.

※ Source: Korea Tourism OrganizationIn 2022, global tourism receipts reached USD 1,031 billion, returning to 69% of pre-pandemic levels, while Korea’s tourism receipts reached USD 11.8 billion in 2022, up 110% from 2021. Each foreign tourist visiting Korea spent an average of USD 3,684 in 2022, which is higher than the global average of USD 1,071. (Unit: USD Billion)

(Unit: USD Billion)Tourism Receipts Years, Global Tourism Receipts, Korea Tourism Receipts Year Global Tourism Receipts Korea Tourism Receipts 2019 1494 20.7 2020 559 10.2 2021 638 10.6 2022 1031 11.8 (Unit : USD)Average per capita spending of tourists Years, Global, Korea Year Global Korea 2019 1020 1185 2020 1373 4042 2021 1399 10985 2022 1071 3684  ※ Source: UNWTO (UN World Tourism Organization)

※ Source: UNWTO (UN World Tourism Organization)

※ Source: Korea Tourism Data Lab (www.datalab.vistkorea.or.kr) 2022 figures are tentative.

※ Source: Compiled from UNWTO and Korea Tourism Data Lab/KOTRA data -

Competitiveness of the Korean Tourism Market Led by Culture OpenCompetitiveness of the Korean Tourism Market Led by Culture1. Korean culture attracting foreign touristsThe rising global influence of K-content (Korean cultural content) is significantly influencing the inflow of foreign tourists to Korea. In particular, more foreign tourists are visiting Korea, influenced by the content they have watched on major OTT platforms such as Netflix, Amazon Prime Video, Disney+ and Apple TV.2. Tourist Destinations Attracting People Around the WorldThe top five destinations visited by foreign tourists are globally competitive, with Korea's natural scenery combining modern and traditional cultures as well as its cultural heritage and leisure facilities attracting people all over the world. Jeju's visa-free entry, Busan's accessibility to Japanese tourists visiting over the weekend, and Gangwon, Jeonnam and other regions each known for its distinct natural beauty are well-received by foreign tourists.3. Korea’s Tourism InfrastructureKorea’s tourism infrastructure has previously been categorized into five factors (transportation, lodging, restaurants, shopping and information service). The Ministry of Culture, Sports and Tourism expanded the category into ten factors to widen the scope of tourism."NEW ERA TRIP, Tourism of the New Post-Pandemic Era"

- N - New Travel Experiences: Workation The New Normal boosting workcation (work + vacation)

- E - Extremely-Personalized Travel Extremely-personalized individuals looking for customized tour experiences.

- W - Widen the Spectrum of K-Culture The heat of K-culture widening the spectrum of tourism

- E - Evolution of Local Trips Local trips evolving in line with the localization trend

- R - Realizing Net-Zero Tourism Emergence of net-zero tourism to cope with global warming

- A - Accessible Tourism for All Right to travel - trips for everyone to enjoy

- T - Towards Digital Transformation Digital transformation to widen the scope of tourism

- R - Recovering from a Crisis: Wellness Traveling for wellness and healing as the world recovers from a crisis

- I - Iteration between Tourism and Everyday Life Tourism and everyday life merge in the new era without boundaries

- P - Power of Local-Driven Tourism Local tourism growing on its own through creation

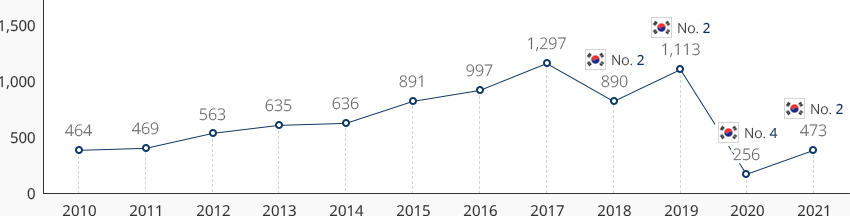

※ Source: Korea Tourism Organization4. Korea, a Leader of the Global MICE IndustryAccording to the Union of International Associations (UIA), Korea hosted 997 international meetings in 2016 and 1,297 meetings in 2017 to rank No. 1 for two straight years. Korea ranked No. 2 in 2018 and 2019. Affected by the pandemic, Korea ranked No. 4 in 2020 before recovering somewhat and ranked No. 2 in 2021.The 2021 UIA report shows that the US ranked No. 1 by hosting 512 international meetings in 2021, followed by Korea with 473 meetings and Japan with 408 meetings."No. of International Meetings Hosted Around the World""No. of International Meetings Hosted in Korea"※ Source: Union of International Associations (UIA), UIA Report

※ Source: Korea Tourism Organization4. Korea, a Leader of the Global MICE IndustryAccording to the Union of International Associations (UIA), Korea hosted 997 international meetings in 2016 and 1,297 meetings in 2017 to rank No. 1 for two straight years. Korea ranked No. 2 in 2018 and 2019. Affected by the pandemic, Korea ranked No. 4 in 2020 before recovering somewhat and ranked No. 2 in 2021.The 2021 UIA report shows that the US ranked No. 1 by hosting 512 international meetings in 2021, followed by Korea with 473 meetings and Japan with 408 meetings."No. of International Meetings Hosted Around the World""No. of International Meetings Hosted in Korea"※ Source: Union of International Associations (UIA), UIA Report

※ Compiled based on UIA statistics -

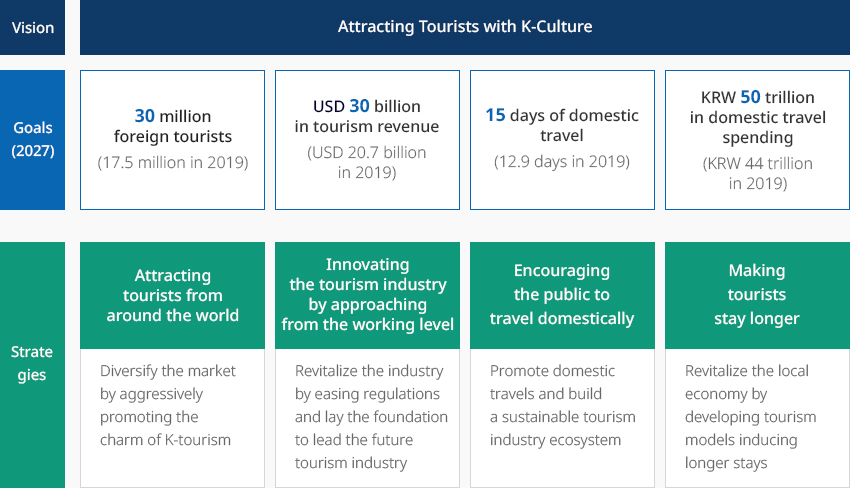

Major Government Policies and Incentives OpenMajor Government Policies and IncentivesThe government convened the 6th Tourism Strategy Meeting and announced plans to combine K-culture and tourism for the objective of achieving by 2027: 30 million foreign tourists, USD 30 billion in tourism revenue, 15 days of domestic travel, and KRW 50 trillion in domestic travel spending.

To that end, detail plans were prepared for: 1. Turning Korea into a country that attracts tourists from around the world, 2. Innovating the tourism industry by approaching from the working level, 3. Encouraging the public to travel domestically, and 4. Making tourists stay longer.

- Vision : Attracting Tourists with K-Culture

- Goals(2027)

- 30 million foreign tourists (17.5 million in 2019)

- USD 30 billion in tourism revenue (USD 20.7 billion in 2019)

- 15 days of domestic travel (12.9 days in 2019)

- KRW 50 trillion in domestic travel spending (KRW 44 trillion in 2019)

- Strategies

- Attracting tourists from around the world : Diversify the market by aggressively promoting the charm of K-tourism

- Innovating the tourism industry by approaching from the working level : Revitalize the industry by easing regulations and lay the foundation to lead the future tourism industry

- Encouraging the public to travel domestically : Promote domestic travels and build a sustainable tourism industry ecosystem

- Making tourists stay longer : Revitalize the local economy by developing tourism models inducing longer stays

※ Source: Ministry of Culture, Sports and TourismThe scope of foreign-invested companies eligible for tax reductions and exemptions is defined in Article 121(2) of the Act On Restriction On Special Cases Concerning Taxation and Article 116(2) of the Enforcement Decree of the same Act . According to Article 18(1)(2) of the Foreign Investment Promotion Act , companies operating in the foreign-invested zones, Free Economic Zones, Saemangeum Project Zone, Jeju Foreign-Invested Zone (individual type) are eligible for a rent reduction of up to 100%, when approved by the Foreign Investment Commission in consideration of benefits to the national economy.※ Acquisition tax and property tax: Reduced or exempt for seven or five years for eligible companies

※ Source: Ministry of Culture, Sports and TourismThe scope of foreign-invested companies eligible for tax reductions and exemptions is defined in Article 121(2) of the Act On Restriction On Special Cases Concerning Taxation and Article 116(2) of the Enforcement Decree of the same Act . According to Article 18(1)(2) of the Foreign Investment Promotion Act , companies operating in the foreign-invested zones, Free Economic Zones, Saemangeum Project Zone, Jeju Foreign-Invested Zone (individual type) are eligible for a rent reduction of up to 100%, when approved by the Foreign Investment Commission in consideration of benefits to the national economy.※ Acquisition tax and property tax: Reduced or exempt for seven or five years for eligible companies

Tourism and leisure businesses operating in the Investment Promotion Zones are also eligible upon investing USD 20 million or more.※ Benefits: Rent reduction or exemption in state-owned public properties, selling of public properties, financing for purchasing sites leased by local governments, land rent reduction or exemption, discount of sales prices, and provision of training subsidies

Local governments are actively supporting foreign investors by enacting ordinances on reduction or exemption of local taxes. -

Tourism Industry Clusters OpenTourism Industry Clusters1. Mega-sized Development of Tourism ClustersConsidering the supply and demand of tourism, the government announced plans to develop tourism Clusters by designating the Seoul Metropolitan Area, Gangwon and Jeju as Mega Tourism Cluster 1, Chungnam, Chungbuk, Daejeon and Sejong as Mega Tourism Cluster 2, Jeonbuk, Jeonnam and Gwangju as Mega Tourism Cluster 3, Daegu and Gyeongbuk as Mega Tourism Cluster 4 and Busan, Ulsan and Gyeongnam as Mega Tourism Cluster 5."Tourism Belt for Building Five Mega Tourism Clusters"※ Source: Ministry of Culture, Sports and Tourism (2021), 4th Master Plan for Tourism Development2. MarinaKorea has eight marinas including Gimpo Terminal, Jebu, Wangsan, Mokpo, Chungmu, Jinhae Myeongdong, Hupo, and Jungmun. Seventy more are scheduled to be added by 2029"Marinas Across Korea"

Marinas Across Korea Type, 현황, 개소 정보 제공 Type 현황 개소 검정 원, 파랑 원 해수면 마리나항만 예정구역 Location 55 주황색 띠 원 내수면 마리나항만 예정구역 Location 15 계 70  ※ Source: Ministry of Oceans and Fisheries (2020-2025), 2nd Master Plan for Marina Development

※ Source: Ministry of Oceans and Fisheries (2020-2025), 2nd Master Plan for Marina Development -

Investment Success Stories OpenInvestment Success Stories1. Multi-purpose ResortsMohegan Sun Resort is a multi-purpose entertainment resort being built in Yeongjongdo, Incheon, and will partially be open in October 2023. Jeju Shinhwa World is a large-scale multi-purpose premium resort being developed by JDC and Hong Kong's Landing Group with key themes inspired by the myths and history of Korea and the Asian region.

- Mohegan Sun (Multi-purpose resort)

- Project period : 2015-2020

- Location : Yeongjongdo, Incheon

- Area : 3,274,000㎡

- Facilities : Hotel, casino, theme park, commercial facilities

- Project budget :USD 4.3 billion

- Korean consortium : Incheon International Airport Corporation

-

Jeju Shinwha World [Jeju Landing] (Multi-purpose resort)

- Project period : partial launch from 2019

- Location : Shinwhayeoksa-ro, Seogwuipo, Jeju

- Area : 3,986,000㎡

- Facilities : Hotel, casino, theme park, commercial facilities

- Project budget : USD 2.4 billion

- Korean consortium : Jeju Free International City Development Center (JDC)

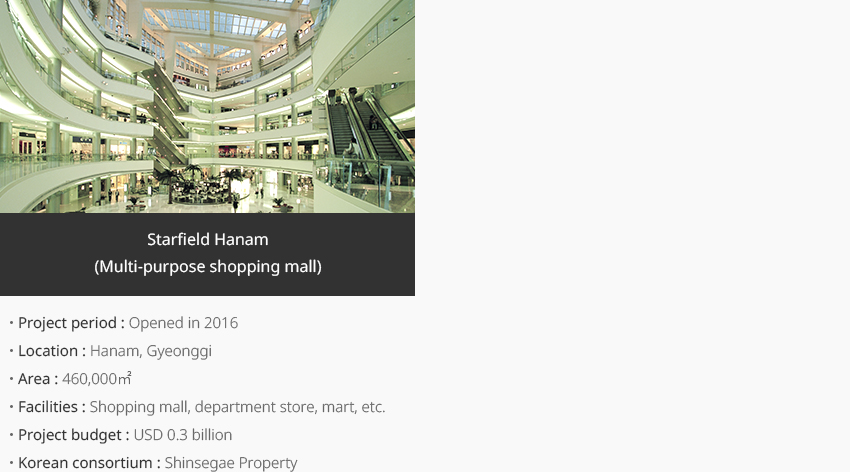

2. Multi-purpose shopping mallsTaubman, a shopping mall developer based in the US, jointly invested with Korea’s Shinsegae Property to open Starfield Hanam in September 2016, with plans to introduce shopping malls in more locations including Goyang.

2. Multi-purpose shopping mallsTaubman, a shopping mall developer based in the US, jointly invested with Korea’s Shinsegae Property to open Starfield Hanam in September 2016, with plans to introduce shopping malls in more locations including Goyang. - Mohegan Sun (Multi-purpose resort)