Finance

- Home

- Investment Opportunities

- Industries

- Finance

-

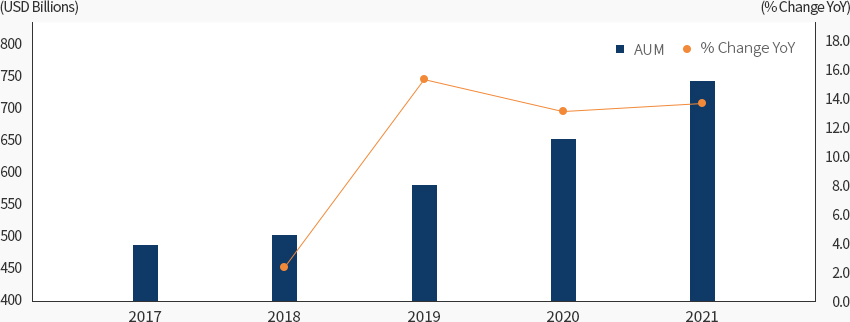

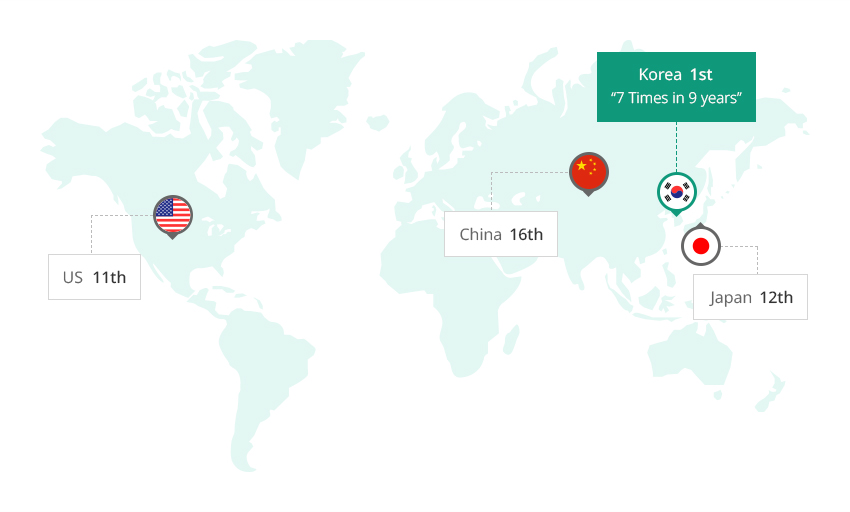

Korea's PEF and Venture Capital Ecosystem Emerging as an Attractive Investment Destination CloseKorea's PEF and Venture Capital Ecosystem Emerging as an Attractive Investment DestinationPrivate equity fund (PEF) and venture capital (VC) creation and investment have been breaking records for several years in a row in Korea, and PEF and venture investment has been very active even amid the global funding slide in 2022.The main growth driver of the Korean PEF market is the increasing investment in PEFs by the domestic pension fund market.For instance, assets managed by the National Pension Service (NPS) grew by 43% to KRW 890 trillion between 2017 and 2022, while the amount invested in alternative assets increased by 119% to KRW 146 trillion during the same period. PEF investments account for 41% of the total amount NPS invests in alternative assets.Innovation is one of the important factors in the venture capital industry. Korea is highly acknowledged globally in that regard, having ranked first in the Bloomberg Innovation Index in 2021.

-

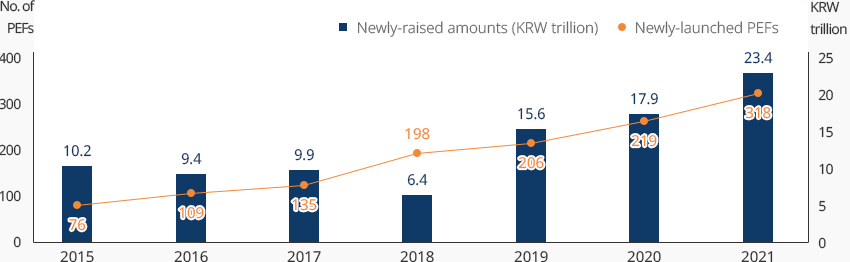

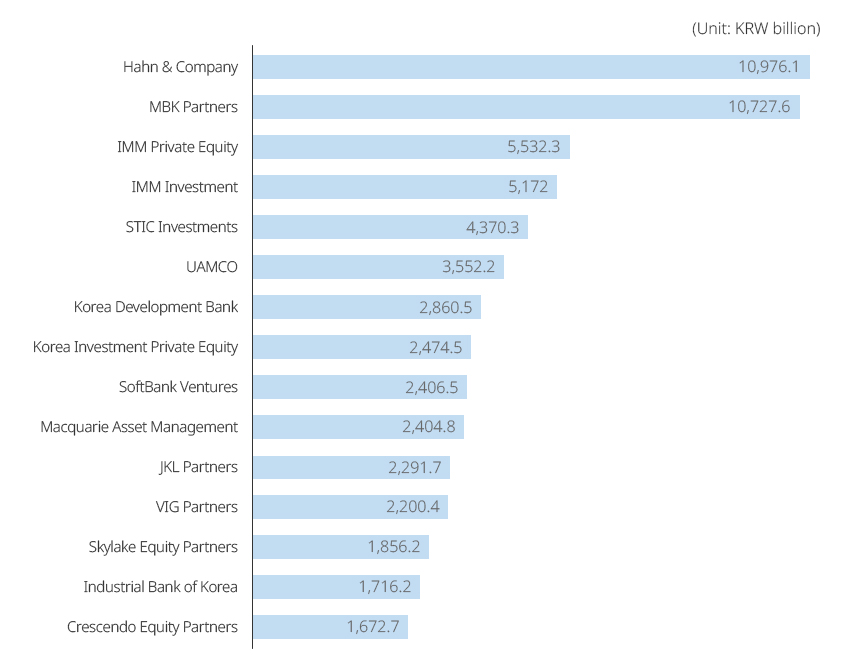

Dramatic Growth of the Korean PEF Market OpenDramatic Growth of the Korean PEF MarketThe Korean PEF market is growing steadily. As of the end of 2021, investors had committed KRW 116.1 trillion to PEFs, up 20% from KRW 96.7 trillion in 2020. The number of new PEFs launched in 2021 totaled 318, up 45% from 219 of the previous year. MBK Partners and Hahn & Company are the top players in the domestic PEF market in terms of assets under management, followed by IMM PE, IMM Investment, and STIC Investment.In line with the growth of the Korean PEF market, major global private equity firms are also establishing offices in Korea For instance, Blackstone Group, the world's largest alternative asset manager based in the US, opened its Seoul office in 2022. Sweden's EQT Partners, which ranks third globally in terms of assets under management, opened an investment office in Seoul in 2023."No. of PEFs, Committed Amount and Invested Amount"

No. of PEFs, Committed Amount and Invested Amount Year, Committed amount(KRW trillion), Invested amount(KRW trillion), No. of PEFs Year Committed amount(KRW trillion) Invested amount(KRW trillion) No. of PEFs 2015 58.5 38.4 316 2016 62.2 43.6 383 2017 62.6 45.5 444 2018 74.4 55.5 580 2019 84.3 61.7 721 2020 96.7 70.2 849 2021 116.1 87.4 1,060 "Newly-launched PEFs and Amounts Raised"Newly-launched PEFs and Amounts Raised Year, Newly-raised amounts (KRW trillion), Newly-raised amounts (KRW trillion) Year Newly-raised amounts (KRW trillion) Newly-raised amounts (KRW trillion) 2015 10.2 76 2016 9.4 109 2017 9.9 135 2018 6.4 198 2019 15.6 206 2020 17.9 219 2021 23.4 318 "Amounts Committed to PEFs as of Dec. 2022" (Unit: KRW billion)

(Unit: KRW billion)- Hahn & Company - 109,761

- MBK Partners - 107,276

- IMM Private Equity - 55,323

- IMM Investment - 51,720

- STIC Investments - 43,703

- UAMCO - 35,522

- Korea Development Bank - 28,605

- Korea Investment Private Equity - 24,745

- SoftBank Ventures - 24,065

- Macquarie Asset Management - 24,048

- JKL Partners - 22,917

- VIG Partners - 22,004

- Skylake Equity Partners - 18,562

- Industrial Bank of Korea - 17,162

- Crescendo Equity Partners - 16,727

※ Source : Financial Supervisory Service

※ Source : Financial Supervisory Service -

Korean Venture Capital Market Growing Steadily Despite the Global Funding Market Slide OpenKorean Venture Capital Market Growing Steadily Despite the Global Funding Market SlideIn line with the US Federal Reserve's tightening policy, venture capital investment fell in 2022 by 12% year-on-year to USD 6.764 trillion, but the amount was still the second-largest on record after 2021.A close look at VCs by sector shows that the top three sectors in 2022 were information and communication technology (ICT) services, retail and services, and biotechnology (bio) and healthcare, accounting for 70.5% of total investment. ICT services accounted for the largest share (35%) of investments at KRW 2.3518 trillion.

NEW VC Investments in Korea by Sector (2022)

NEW VC Investments in Korea by Sector (2022)- IT Services - 34.80 %

- Distribution Services - 19.40 %

- Blotech/Health care 16.30 %

- Meida/Entertainment - 6.80 %

- Machinery Equipment - 6.10 %

- Other - 5.60 %

- IT Manufacturing - 4.40 %

- Chemicals/Mat erials - 4.20 %

- Games - 2.40 %

※ Ministry of SMEs and Startups

※ Ministry of SMEs and Startups -

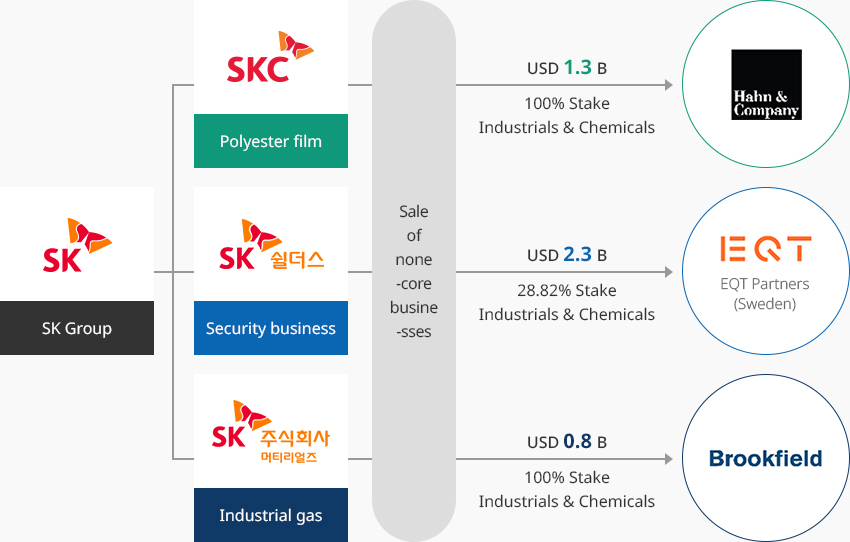

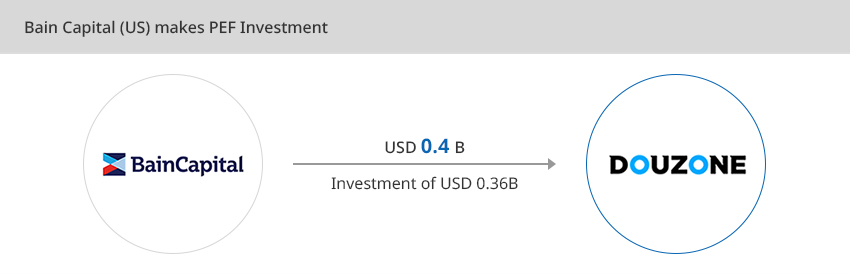

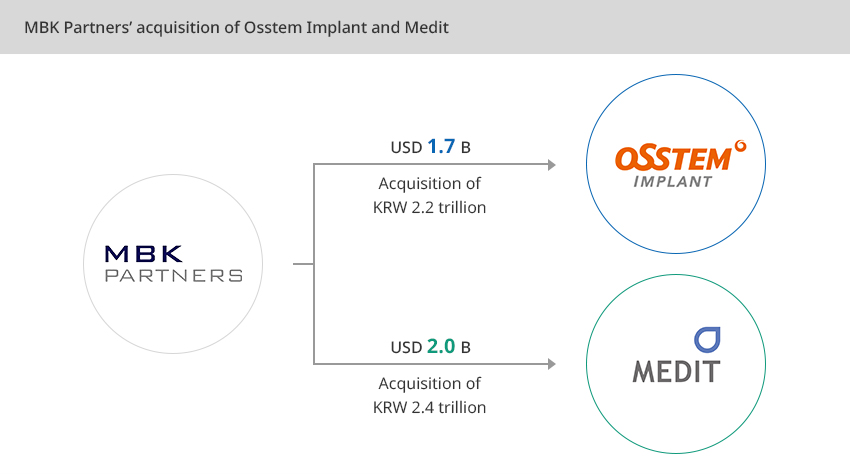

Factors That Make Korean PEFs and the VC Market Attractive OpenFactors That Make Korean PEFs and the VC Market AttractiveRestructuring of Korean conglomeratesIn Korea, the sale of non-core businesses by conglomerates aimed at restructuring their businesses is an important driver of growth in the Korean PEF market. PEFs are pursuing the strategy of acquiring non-core businesses of conglomerates and selling them back at an increased value. For instance, in 2022 and 2023, SK Group sold non-core businesses such as polyester film (SKC), industrial gas (SK Materials), and security (SK Shields) to private equity firms such as Sweden's EQT Partners."SK Group Reorganization"Digital Transformation of Korean CompaniesDigital transformation of the Korean economy is in full swing. In recent years, numerous e-commerce, software, and other digital transformation companies, including Coupang, Yanolja, and Douzone Bizon, have raised funds from financial investors. A case in point is Douzone Bizon, the nation's leading ERP software developer, which received a USD 0.36 billion investment from the US-based Bain Capital private equity fund in 2021.Succession of Korean Conglomerates Emerging as Investment OpportunitiesThe succession of Korean conglomerates has emerged as another financial investment opportunity. With the retirement of the founders of major players in various traditional industries that have led the development of national economy since the 1960s, a number of companies are selling their control. A case in point is the founder of Hanssem Interior who reached his 80s and sold his company to IMM Private Equity in 2021 at USD 1.2 billion.Korea's Aging Population Also Presenting Investment OpportunitiesKorea has a rapidly aging population, which provides more investment opportunities in the healthcare industry. For example, MBK Partners - Korea's largest private equity firm - acquired dental implant maker Osstem Implant for KRW 2.2 trillion in 2023. Around the same time, the company also acquired oral scanner maker Medit for KRW 2.4 trillion.

-

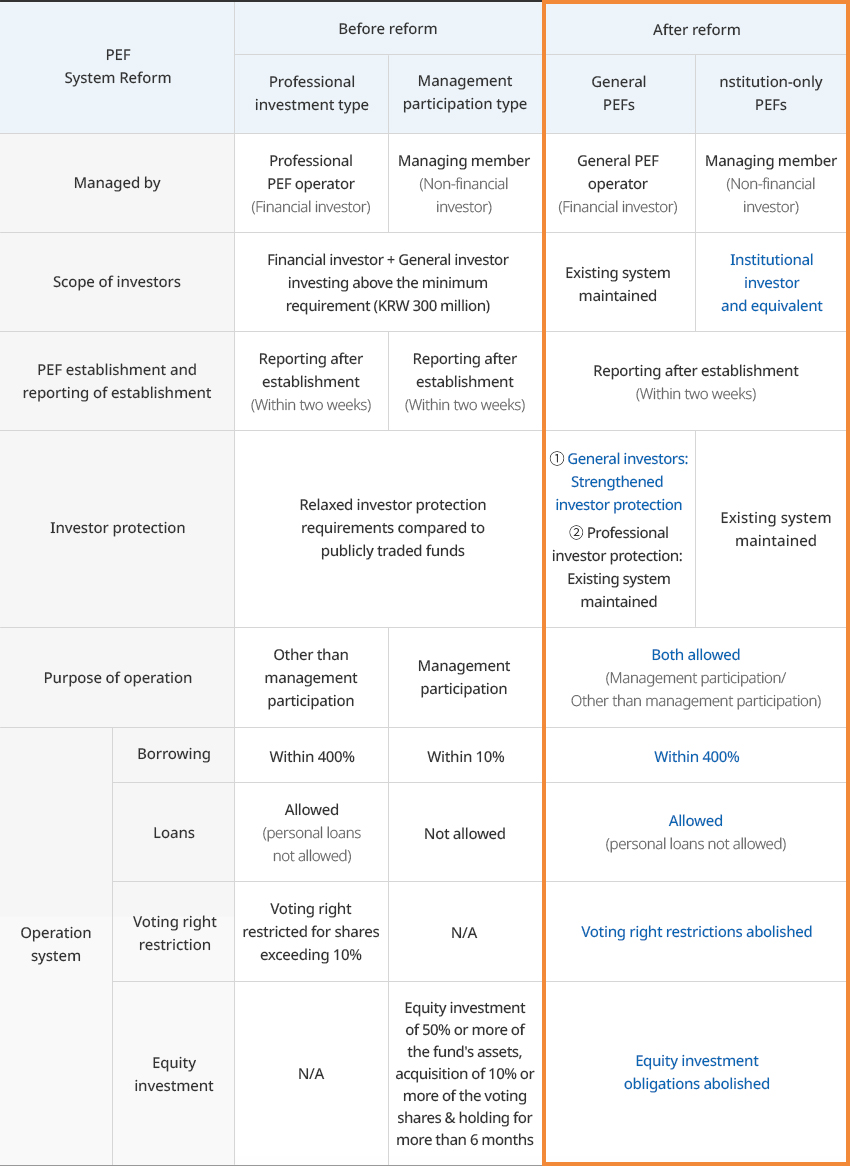

PEF System Reform and Venter Investment Promotion Policies OpenPEF System Reform and Venter Investment Promotion PoliciesPEF system reformThe reformed PEF system has been in place as of October 2021 in Korea. The most notable change is the classification of PEFs from professional investment type and management participation type to general PEFs and institution-only PEFs. The relaxed system allows for a wider range of investment strategies for purposes other than management participation."PEF System Reform: Before and After"

PEF System Reform: Before and After PEF System Reform, Before reform, After reform PEF System Reform Before reform After reform Professional investment type Management participation type General PEFs Institution-only PEFs Managed by Professional PEF operator (Financial investor) Managing member (Non-financial investor) General PEF operator (Financial investor) Managing member (Non-financial investor) Scope of investors Financial investor + General investor investing above the minimum requirement (KRW 300 million) Existing system maintained Institutional investor and equivalent PEF establishment and reporting of establishment Reporting after establishment (Within two weeks) Reporting after establishment (Within two weeks) Reporting after establishment (Within two weeks) Investor protection Relaxed investor protection requirements compared to publicly traded funds ① General investors: Strengthened investor protection ② Professional investor protection: Existing system maintained Existing system maintained Purpose of operation Other than management participation Management participation Both allowed (Management participation/Other than management participation) Operation system Borrowing Within 400% Within 10% Within 400% Loans Allowed (personal loans not allowed) Not allowed Allowed (personal loans not allowed) Voting right restriction Voting right restricted for shares exceeding 10% N/A Voting right restrictions abolished Equity investment N/A Equity investment of 50% or more of the fund's assets, acquisition of 10% or more of the voting shares & holding for more than 6 months Equity investment obligations abolished  ※ Source: Financial Services CommissionGovernment policies to promote venture investment and foster venture companiesThe Venture Investment Promotion Act (hereinafter the Venture Investment Act) was enacted in Korea in February 2020 and has been in effect since July 2020. Based on the Act, the venture investment systems stipulated across different laws were realigned to create a consistent venture investment ecosystem, and regulations were relaxed to facilitate private venture capital investment and individual angel investment.In addition to venture capital funds that directly invest in companies, the amendment to the Venture Investment Act in April 2023 provides the legal basis for the formation of private indirect venture capital funds, which can increase stability through indirect and decentralized investments in venture capital funds. By allowing the private sector to act as a parent fund, the amendment is expected to facilitate the inflow of private funds into the venture investment market.From November 2023, unlisted venture companies whose founders' voting rights have declined due to large-scale stock issuance will be able to issue multiple voting shares with the consent of shareholders. The system applies if the founder of the venture company attracts investment to see his/her shares reduced to 30% or less or loses the status as the largest shareholder.

※ Source: Financial Services CommissionGovernment policies to promote venture investment and foster venture companiesThe Venture Investment Promotion Act (hereinafter the Venture Investment Act) was enacted in Korea in February 2020 and has been in effect since July 2020. Based on the Act, the venture investment systems stipulated across different laws were realigned to create a consistent venture investment ecosystem, and regulations were relaxed to facilitate private venture capital investment and individual angel investment.In addition to venture capital funds that directly invest in companies, the amendment to the Venture Investment Act in April 2023 provides the legal basis for the formation of private indirect venture capital funds, which can increase stability through indirect and decentralized investments in venture capital funds. By allowing the private sector to act as a parent fund, the amendment is expected to facilitate the inflow of private funds into the venture investment market.From November 2023, unlisted venture companies whose founders' voting rights have declined due to large-scale stock issuance will be able to issue multiple voting shares with the consent of shareholders. The system applies if the founder of the venture company attracts investment to see his/her shares reduced to 30% or less or loses the status as the largest shareholder. -

Investment Success Stories OpenInvestment Success StoriesDIG AirgasDIG Airgas is Korea's leading industrial gas provider founded in 1979 and acquired by MBK Partners in 2017.In 2020, MBK Partners sold DIG Airgas, achieving a return of over 100% in less than three years.Macquarie Group of Australia acquired the company from MBK Partners for USD 2.2 billion, with participation from a number of global LP investors, including the Government of Singapore Investment Corporation (GIC) and the pension fund of Alberta, Canada.YanoljaYanolja is a Korean travel platform founded in 2005 that has grown into the country's largest online travel platform in just over 18 years.In 2019, the company became a unicorn with USD 180 million in funding from Booking Holdings, a major US travel platform, and the Government of Singapore Investment Corporation (GIC).In 2021, it was listed as a decacorn with a USD 1.7 billion investment from Japan's Softbank. Yanolja plans to go public in the coming years.