FAQ

- Home

- 投資ガイド

- FAQ

- FAQ

- 全体

- Definitions

- Notification

- Establishment of Corporation

- Real Estate Acquisition

- Taxation and Accounting

- Factory Establishment and Location

- Labor

- Environment

- Visa

- Settlement

- Legal Interpretations

-

No. When food wastes or byproducts of agriculture and fisheries are used as raw materials, “composted organic fertilizer production facilities” are not included in the scope of “organic fertilizer manufacturing facilities” pursuant to Article 29 (7) 4 of the Enforcement Decree of the Farmland Act. .

The purpose of the Farmland Act is to contribute to the strengthening of agricultural competitiveness, balanced development of the national economy, and preservation of national environment through the efficient usage and management of farmland (Article 1). Meanwhile, the purpose of the Fertilizer Control Act is to maintain and promote agricultural productivity, and to protect agricultural environment by preserving the quality of fertilizers, as well as ensuring their smooth supply/demand and price stability (Article 1). In this regard, it is fair to say that regulations related to agricultural activities shall be interpreted in a coordinated and coherent manner under the purpose of relevant laws.

Given that the Farmland Act does not specifically prescribe the meaning or scope of “organic fertilizer manufacturing facilities”, the scope of such facilities permitted in an agricultural promotion area shall be determined based on the classification of the Fertilizer Control Act. Under Article 11 (1) of the Fertilizer Control Act, a person intending to operate a business of producing and selling, or distributing or supplying fertilizers free of charge shall register as a fertilizer production business. Also, in subparagraphs 2 (b) 1 and 2 of attached Table 2 of the Enforcement Decree of the Farmland Act which stipulates the facility standards for registering a fertilizer production business, composted organic fertilizers and organic fertilizers are classified separately. In addition, under the aforementioned regulation, the facility standards required for composted organic fertilizers are prescribed as “production facilities such as fermentation facilities”, while those applied to organic fertilizers are stated as “production facilities such as motorized pulverizers or drying equipment”. In addition, under Articles 2 (2) 1 and 2 and attached Tables 1 and 3 of the guidelines for establishing legal standards for fertilizers publicly announced by the Administrator of the Rural Development Administration in accordance with Articles 4 and 26 of the Fertilizer Control Act and Article 19 (2) 1 of the Enforcement Decree of the same Act, composted organic fertilizers and organic fertilizers are separately defined and the legal standards for each type of fertilizer under the two categories are prescribed. .

In this regard, based on the system of classification under the Fertilizer Control Act which separately defines composted organic fertilizers and organic fertilizers, it can be said that composted organic fertilizers are different from organic fertilizers with regard to the types of production facilities, legal standards, etc.

Therefore, because Article 29 (7) 4 of the Enforcement Decree of the Farmland Act prescribes that the facilities that can be installed in an agricultural promotion area shall be “organic fertilizer production facilities”, it is reasonable to conclude that “composted organic fertilizer production facilities” are not included in the scope of “organic fertilizer production facilities” that can be installed in an agricultural promotion area.

Furthermore, when considering the purpose of the Farmland Act, which is to strengthen agricultural competitiveness through efficient usage and management of farmland, and also the objective of Article 32 (1) of the same Act, which specifies restrictions on acts in an agricultural promotion area in order to preserve farmland in the area, the acts that are permitted inside an agricultural promotion area pursuant to the subparagraphs of the aforementioned Article and Articles 29 (2) through (7) of the Enforcement Decree of the Act should be regarded as a restrictive and positive list, and therefore it should be restrictively interpreted that installation of “organic fertilizer production facilities” under Article 29 (7) 4 of the Enforcement Decree is permitted as long as it does not disrupt the effective utilization of farmland and strengthening of agricultural competitiveness.

Article 32 (Restriction on Acts in Specific-Use Areas)

(1) No one shall engage in any act of utilizing land, other than the acts prescribed by Presidential Decree and directly related to agricultural production or farmland improvement within an agricultural promotion area: Provided, That the foregoing shall not apply to the following:

1. ~ 8. (Omitted)

9. Installation of facilities prescribed by Presidential Decree and necessary for development of agricultural and fishing villages, including the development of income sources of agricultural and fishing villages.

Article 29 (Acts that are permitted in an agricultural promotion area)

(1) to (6) (Omitted)

(7) "Facilities prescribed by Presidential Decree and necessary for development of agricultural and fishing villages" prescribed by Article 32 (1) 9 of the Act means the following facilities:

1. ~ 3. (Omitted)

(7) "Facilities prescribed by Presidential Decree and necessary for development of agricultural and fishing villages" prescribed by Article 32 (1) 9 of the Act means the following facilities:

1. ~ 3. (Omitted)

4. Organic fertilizer manufacturing facilities using food waste or agricultural or fisheries by-products whose total area measures less than 3,000 m2 (10,000 m2 for facilities installed by a local government organization or an agricultural producers' group)

4-2 to 10. (Omitted)

Article 2 (Definition)

The terms used in this Act are defined as follows:

1. and 2. (Omitted)

3. The term "by-product fertilizer" means any fertilizer the legal standards of which are established under Article 4 and which is produced by utilizing by-products, human excrements and urine, food wastes, soil-microbiological products (including manufactured products and soil-enzyme agents), soil activation agents, etc. produced in the course of operating an agriculture, forestry, livestock, fishery, manufacturing, or marketing business;

4. The term "legal standards" means the standards determined and publicly announced by the Minister of Agriculture, Food and Rural Affairs with regard to any fertilizer, the standards of which is deemed necessary to be determined by the Minister of Agriculture, Food and Rural Affairs for the purpose of maintaining the quality of the fertilizer, for matters such as the minimum quantity of its main raw materials, the maximum allowable content of harmful ingredients of the fertilizer, the content of additional ingredients required for maintaining the effects of its main ingredients, its best before date, etc.;

5 and 6. (Omitted)

Article 4 (Establishment of Legal Standards)

(1) to (3) (Omitted)

(4) Where the Minister of Agriculture, Food and Rural Affairs intends to perform the establishment, etc. of legal standards, he or she shall publicly notify them publicly 30 days in advance.

Article 11 (Registration of Fertilizer Production Business)

(1) Any person who intends to run a business of producing and selling, or distributing or supplying fertilizers free of charge (including those who intend to reclaim fertilizers from wastes provided for in the Wastes Control Act and sell, or distribute or supply them free of charge) shall register raw materials for production, certified ingredients, etc. with the head of a Si (including a Special Self-Governing City Mayor and a Special Self-Governing Province Governor; hereinafter the same shall apply)/Gun/Gu (referring to the head of an autonomous Gu; hereinafter the same shall apply) for each kind of fertilizer, as prescribed by Presidential Decree: Provided, That this shall not apply in cases of a by-product fertilizer production business not in excess of the scale prescribed by Presidential Decree.

(2) (Omitted)

(3) Facilities required for the registration of a fertilizer production business prescribed in paragraph (1) and other registration standards shall be prescribed by Presidential Decree.

(4) to (8) (Omitted)

Article 12 (Facilities necessary for registration of fertilizer production business and other registration standards, etc.)

(1) The facilities necessary for registration of fertilizer production business and the registration standards pursuant to Article 11 (3) of the Act are as prescribed by attached Table 2.

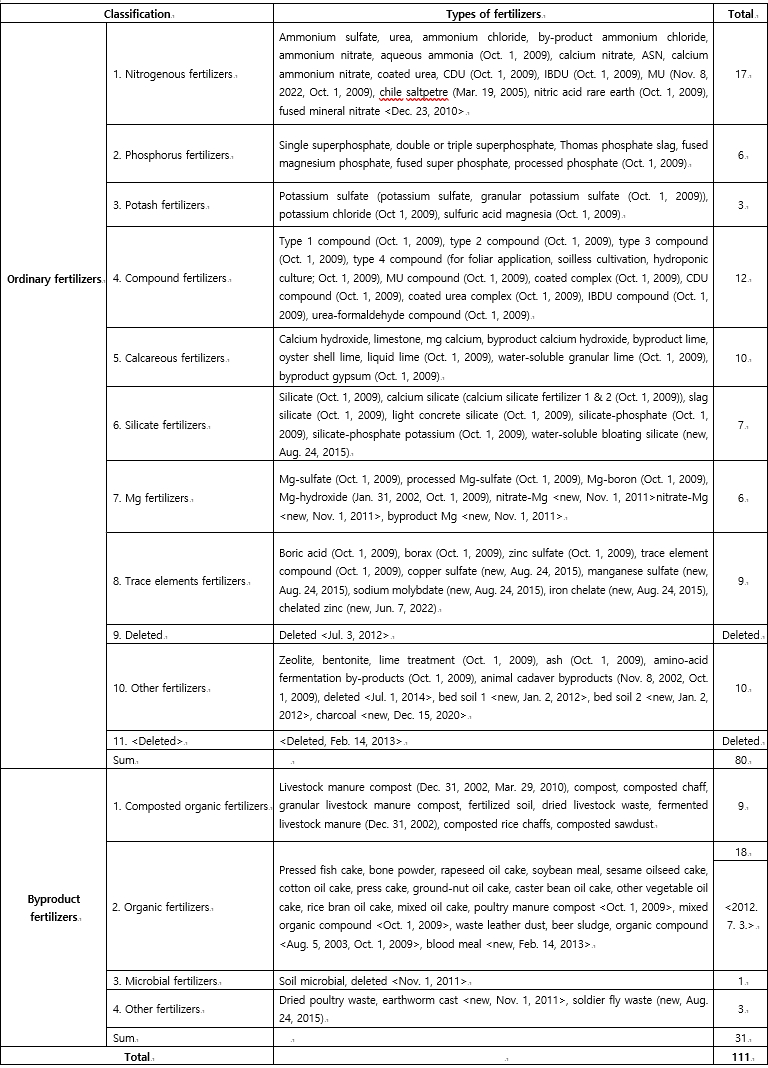

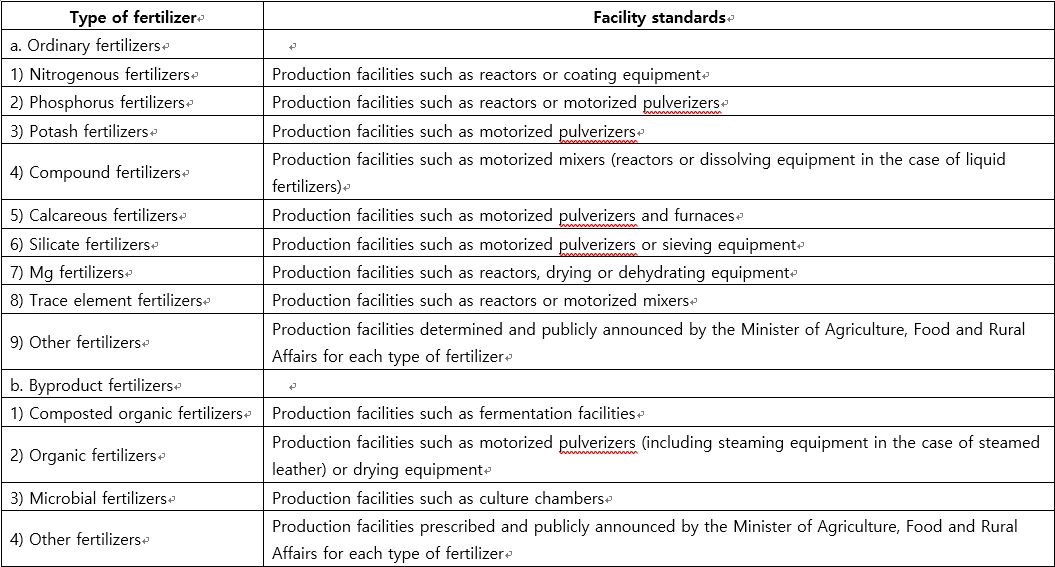

■ Enforcement Decree of the Fertilizer Control Act [Attached Table 2]

Facilities necessary for registration of fertilizer production business and other registration standards (related to Article 12 (1))

1. Common facilities

Storage warehouse (not applicable for by fertilizer production business using by-products) and quantity check and packaging equipment (only where fertilizer is packaged and sold).

2. Production facility by type of fertilizer

Establishment of Legal Standards for Fertilizers (Public Notice of Rural Development Administration)

Article 2 (Classification of Fertilizers)

(1) (Omitted)

(2) Byproduct fertilizers pursuant to subparagraph 3 of Article 2 of the Act shall be classified as follows:

1. “Composted organic fertilizers” refers to fertilizers produced through the process of composting using byproducts, human excrement or food waste generated in the business of agriculture, forestry, livestock and fisheries, and production and sales as its main raw materials, and ordinary fertilizers other than those prescribed in attached Table 5 should not be added.

2. “Organic fertilizers” refers to fertilizers produced using organics as its main raw materials, which guarantee a minimum amount of nitrogen, phosphate, potassium, and organic matters

3 & 4. (Omitted)

(3) The classification and types of fertilizers pursuant to paragraphs 1 and 2 are as prescribed in attached Table 1.

[Attached Table 1] Classification and Types of Fertilizers

-

"In this case, the individual business does not lose its status as a business starter.

The purpose of the Act is to contribute to the establishment of a solid industrial structure through sound development of small and medium enterprises (SMEs) by facilitating the establishment of SMEs and developing a firm basis for growth (Article 1). Also, under subparagraph 1 of Article 2 of the Act and Article 2 (1) of the Enforcement Decree of the Act, a “business start-up” means establishing a “new” SME, and subparagraph 3 of Article 2 of the Act prescribes “business starter” as a person who starts up an SME or a person who has been engaged in his or her business “for less than seven years since commencing the business”.

In addition, pursuant to Article 3 (1) of the Act, the Act shall apply to business startup, excluding starting up such types of businesses that are clearly against the economic order and good public morals, such as gambling business. With the amendment of the Act in December 2018 to expand the types of businesses subject to support of startup to all businesses, real estate business became subject to the law as well.

In other words, the purpose of the amendment of the Act is to make the support and benefits provided pursuant to the Act applicable to real estate businesses as well. However, if it is assumed that the “business commencement date” of a person who operated a real estate business before the amendment of the Act and became a business starter by additionally starting a wholesale and retail business under the Act is applied retroactively to the date of commencement of the real estate business and he/she loses wholesale and retail business starter status when seven years pass from the aforementioned date, it will violate the purpose of the Act and purpose of its amendment. Moreover, it will be unreasonable because the status as business starter will be lost due to unforeseen circumstances.

Under the Enforcement Decree of the Act amended in October 2020, it is stated that where an individual small and medium entrepreneur establishes a new SME while operating his/her existing business, it shall not be considered starting up a business. However, the Act prescribes transitional measures (Article 2 of the Addenda of the Act) under which a business starter that commenced business according to the regulations before the enactment of the Enforcement Decree of the Act shall be considered a business starter until seven years have not passed from the date of commencing business pursuant to the pre-amendment regulations. So, as in this case in which a person operating a real estate business became a business starter by additionally operating a wholesale and retail business, he/she shall maintain his/her status as a starter of a wholesale and retail business, in accordance with such transitional measures.

Therefore, in this case, the date of business commencement that is used to determine whether the person is a wholesale/retail business starter shall not apply retroactively to the date of commencement of the real estate business. Consequently, the business operator shall not lose his/her status as a business starter." -

" Yes, in this case, the person can be considered a “shipowner”

Under the Seafarers’ Act, the term “shipowner” means a shipowner, ship managing business operator who is entrusted with the responsibility for the operation of a ship by a shipowner and agrees to take over the rights, responsibility, and obligations of a shipowner under the Act, his/her agent, ship charterer, etc. (subparagraph 2 of Article 2). In this regard, it can be considered that a person who is or corresponds to the persons listed before “etc.” of the same subparagraph can be included in the scope of shipowners.

However, because ship managing business operators or agents are not obligated to take over all of the shipowner’s rights and responsibilities, “shipowner” cannot be limited to persons who have been entrusted with all matters regarding the ship’s operation. Also, the Seafarers’ Act does not define “operation”. Ship managing business operators manage the technical and commercial aspect of a ship in addition to the operation of a ship, and the Seafarers’ Act defines that maritime passenger transport business is a business for transporting passengers and goods and overseeing the relevant matters. In light of this, it should be considered that “operation of a ship” prescribed by subparagraph 2 of Article 2 of the Act shall include the work that is done to provide convenience to passengers of the ship.

If so, the person who leased a snack bar or restaurant in of a passenger ship is a person who is entrusted with the responsibility to provide convenience to passengers and therefore should be regarded as having taken over the rights and responsibilities of a shipowner pursuant to the Act. In this regard, it is appropriate to consider that the person who has leased a snack shop or restaurant in a passenger ship Act is a shipowner

In addition, in regard to the “seafarer labor contract” (subparagraph 9 of Article 2) and “wages” (subparagraph 10 of Article 2) under the Act, the relationship between the shipowner and seafarer is defined. And when we look at the definition of “seafarer” as “a person who is employed to provided labor in a ship to which this Act applies” (subparagraph 1 of Article 2), the definition is based on the place of employment, not the employer. In consideration of such regulation, it will be reasonable to interpret that a person who is at the position to employ seafarers – persons who are to work at a ship under the Act – should be considered shipowners unless special causes for exception apply. If the lessee of a snack bar or restaurant who employed a seafarer to work at the bar or restaurant is not considered a shipowner, the regulations under the Act which define the employment conditions of a seafarer that a shipowner has to adhere to such as regulations on the employment contract, wage, working hours, paid leaves, etc. of seafarers will not apply. If so, it will be contradictory to the purpose of legislating the Seafarers Act, which is to apply regulations that are different from that of the Labor Standards Act stipulating the general employment relations of workers, because seafarers are exposed to special working conditions as they work and live in an isolated ship for a long period of time and are exposed to seafaring risks such as sinking or running aground of the ship. " -

"Yes, in this case, the shipowner can have the seafarer qualified for passenger safety management to concurrently hold the role as a seafarer for safety management of passengers.

Under Article 64 (5) of the Seafarers' Act and Article 21 (4) of the Enforcement Decree of the same Act, it is prescribed that the owner of a ship shall have on board a seafarer who is qualified for passenger safety management as a seafarer for safety management of passengers. Also, in the Enforcement Rules of the same Act, a seafarer for safety management of passengers is defined as a seafarer who completed advanced safety training course for passenger ships, and penalty is imposed where a shipowner does not have a seafarer for safety management of passengers on board pursuant to Article 173 (1) 8 of the Act. And considering the fact that administrative regulations that act as the basis for administratively disadvantageous measures should be interpreted and applied in a strict manner and should not be extensively or analogically interpreted, Article 64 (5) of the Seafarers' Act should be interpreted in a strict manner.

However, Article 64 (5) of the Seafarers' Act only prescribes that shipowners should ensure that seafarers who are qualified for passenger safety management are "on board", and does not have explicit regulations that require the seafarer for safety management of passengers to be an additional seafarer or ban the seafarer from concurrently holding another role.

Moreover, where there are no explicit regulations banning the concurrent holding of roles, concurrent holding of roles should be permitted or restricted based on consideration of the characteristics of the work concerned or whether work will be disrupted. But because the Enforcement Rule of the Seafarers' Act prescribes that the shipowner shall assign duties such dispensing and demonstrating how to put on live saving appliances such as lifejackets in case of emergency, assisting passengers in boarding a survival craft and other passenger supporting duties in emergency as ordered by the captain to seafarers for safety management of passengers, which implies that such seafarers' duties cannot be considered full-time work, it cannot be considered that it is banned to have a seafarer on board to concurrently hold the post.

In addition, under Article 65 (1) of the Act, a shipowner shall fix the full strength of necessary seafarers (hereinafter "complement") to satisfy Articles 60 (Working Hours and Time to Rest), 64 (Work on Board of Qualified Seafarers) and 76 (Providing Meals in Ships) and obtain approval therefor from the competent maritime affairs and port authorities. Also, the Enforcement Rule of the same Act requires that the certificate of the complement should state the total number of persons requiring additional qualification and prescribes that additional complements are not required for medical care persons, emergency care persons, seafarers of ships carrying dangerous cargoes, life-raft operators and seafarers for passenger safety management. Considering such facts, it should be deemed that seafarers for passenger safety management who are classified as seafarers requiring additional qualification are included in the regulations on complements under the premise that the position can be concurrently held.

In consideration of the above, it is reasonable to conclude that where a seafarer of a passenger ship is qualified as a seafarer for passenger safety management, the shipowner can allow the said seafarer to concurrently hold the post of seafarer for passenger safety management. "

-

"Registration of a construction business as prescribed in the main sentence of Article 9 (1) of the Framework Act on the Construction Industry, etc. (hereafter “the Act”) cannot be filed with two or more individuals as its joint representatives.

The main sentence of Article 9 (1) of the Act prescribes that a person who intends to run a construction business shall file for registration with the Minister of Land, Infrastructure and Transport by category of business, and Article 10 of the same Act states that the particulars that constitute the standards for registration of construction business such as technological capabilities, capital, facilities and equipment, and other necessary matters shall be prescribed by Presidential Decree. Also, Article 13 (1) of the Enforcement Decree of the Act, which provides matters delegated by the Act and those necessary for the enforcement thereof, prescribes the standards for registration of a construction business. For example, a business shall have secured a certain number of technical workforce with qualifications prescribed by the National Technical Qualifications Act as well as capital by category of business and office (subparagraph 1), and financial institutions, etc. designated by the Minister of shall evaluate the financial status and credit status, etc. of persons applying for registration of the possible amount of guarantee, and according to the results of relevant evaluations, obtain security or a deposit of cash within the capital by business type (subparagraph 1-2). The purpose of such regulations is to prevent faulty constructions and to protect the lives and properties of people by only allowing persons that meet the minimum qualifications that guarantee proper construction to register and execute construction. In this regard, regulations related to the registration of a construction business should be interpreted considering such aforementioned purpose.

In addition, a “constructor” who registered a construction business by meeting certain registration conditions pursuant to the main sentence of Article 9 (1) and 10 of the Act and operates the business is a person who is granted the status of a construction business operator under public law. They face sanctions such as cancellation of registration if they no longer satisfy the registration standards, and as a constructor, they may be punished for violation of the Act and other laws related to the safety of construction works, which means that a constructor has public law relations with the relevant laws. Therefore, it is difficult to assume that an unlimited number of individuals or companies can jointly acquire a status as a constructor and become subject to the rights and responsibilities set forth in the Act.

To make it mandatory to fulfill the obligation to register a construction business and to enforce compliance with the registration standards, the Act has some strict regulations. For example, the Act prescribes that persons who did not register construction business or operated a construction business after registering the business through improper means are subject to criminal punishment (Article 96), prohibits the lending of construction business registration certificate to another person (Article 21), and restricts the qualification of contractors without adequate execution capacity based on his/her performance records of construction works, capital, etc. and public announcement records (Article 23, 25). In this regard, if it can be assumed that two or more individuals can become joint representatives and register a construction business, it will not be possible to prevent a qualified person from becoming joint representatives with non-qualified persons, which may disable the regulations such as prohibition of lending construction business registration certificate, assessment of execution capacity and restriction of qualification of contractor.

Moreover, when deciding whether it can be permitted to have a construction business be registered by two or more joint representatives, the fact that the following matters are not clearly stipulated by law should be considered:

- Up to what extent the contribution of each joint representative should be recognized when determining whether a construction business satisfies the registration standards (Article 10)

- Whether registration of construction business can be cancelled if one or more joint representatives are disqualified for registration of construction business (Article 13 (1), 83)

- Where one or more joint representatives dies, whether their heir can inherit their status as constructor (Article 17 (4))

- Where the penalty provisions of Article 93 (1), etc. and joint penalty provisions of Article 98 of the Act apply, whether the representatives shall be held jointly accountable or a single representative shall be solely accountable

Therefore, based on a comprehensive interpretation of the construction business registration system, purpose, structure, etc. of the Act, it shall be deemed that a person who intends to register a construction business under the main sentence of Article 9 (1) should be deemed a single individual or a single company. " -

"Yes. In this case, the product is subject to order to collect, etc. pursuant to Article 8 (1) 1 of the Act.

Article 5 (1) of the Act prescribes that a person who intends to manufacture an electrical appliance subject to safety certification or intends to manufacture such product abroad and import it to Korea should obtain safety certification for each model of electrical appliance subject to safety certification, while stipulating that an exceptional case for which safety certification is not required is when the confirmation of the Minister of Trade, Industry and Energy is obtained as an electrical appliance subject to safety certification that is manufactured for the purpose of export (subparagraph 1). According to the said regulation, a product manufactured by a person manufacturing an electrical appliance subject to safety certification should, in principle, obtain safety certification, and in order to be exempted from obtaining a safety certification, the product should both “be manufactured for the purpose of export” and “obtain confirmation from the Minister of Trade, Industry and Energy”.

Also, Article 8 (1) 1 of the Act only prescribes that the mayor or provincial governor can order the collection, etc. of an electrical appliance subject to safety certification when it has not obtained a safety certification, and does not classify the types of appliances subject to collection, etc. pursuant to the purpose of manufacturing the product.

If so, it should be considered that even if such appliance is manufactured for the purpose of export, it is subject to safety certification if it has not obtained the confirmation of the Minister of Trade, Industry and Energy. In this regard, if the appliance did not go through the procedure for exemption of safety certification as prescribed by law, it shall be deemed that the appliance did not fulfill its obligation to obtain safety certification.

Therefore, the said product is subject to order for collection, etc. under Article 8 (1) 1 of the Act, although whether a mayor or provincial governor can actually order the collection, etc. of a product that has been exported considering the executability of the law in a foreign country should be discussed as a separate matter. " -

"Yes, such act is subject to administrative disposition pursuant to Articles 37 and 49 of the Foreign Trade Act.

Where laws with varying legislative purposes each prescribe different requirements for performing a certain act and a specific act meets the requirements of two or more laws, all of such laws shall apply, as long as it is not interpreted that one law is applied exclusively over another law.

The purpose of the Fair Trade Act is to contribute to the growth of the national economy by promoting foreign trade, establishing a fair trade system, maintaining international balance of payments, and expanding commerce (Article 1), while that of the Act on Prevention of Divulgence and Protection of Industrial Technology is to prevent undue divulgence of, and protect, industrial technology in order to strengthen the competitiveness of Korean industries and contribute to national security and development of the national economy (Article 1). In other words, the two laws are separate laws with different legislative purposes, and it cannot be considered that one law applies exclusively over another law.

However, in the main sentence of Article 19 (2) of the Foreign Trade Act excluding its subparagraphs, it is prescribed that any person who intends to export strategic items shall obtain export permission, and Article 31 (1) 1 and Subparagraph 1 of Article 49 of the same Act stipulate that persons who exported strategic items without obtaining export permission shall be placed with a restriction on exportation or importation or ordered to take a training course. Also, under Article 11 (4) of the Act on Prevention of Divulgence and Protection of Industrial Technology, it is prescribed that where an institution possessing industrial technology which has and manages national core technology, other than that approved pursuant to paragraph 1, intends to export the national core technology, it shall report it to the Minister of Trade, Industry and Energy in advance.

If so, where intending to export a technology that is considered a strategic item pursuant to the Foreign Trade Act, it is apparent that an export permission according to the Foreign Trade Act should be obtained and a report under the Act on Prevention of Divulgence and Protection of Industrial Technology should be filed. Therefore, if such technology is exported without obtaining an export permission or filing a report, it shall be deemed that an administrative disposition shall apply pursuant to Articles 31 and 49 of the Foreign Trade Act. " -

"Yes, Korean local governments are included.

Article 13 (4) of the Act on the Promotion of Building Service Industry (hereafter the “Act”) stipulates that where the State and local governments select designers through a public competition in order to encourage competent architects to participate in public projects, they may limit the participation in the competition to architects who meet the requirements prescribed by Presidential Decree. Article 11 (1) of the Enforcement Decree of the same Act states that one of the qualifications is that the architect shall have a record of winning a local or international public competition hosted by the Korean government or a foreign government (subparagraph 1), but does not explicitly prescribe the scope of “government”. So in order to define “government”, the contents of the regulation, the purpose of its legislation, and relationship with other laws with a similar legislative purpose should be collectively considered.

The purpose of the Act is to establish the foundation for developing the building service industry and to contribute to enhancing public convenience and advancing the national economy through the promotion of the building service industry by providing for matters necessary to support and foster the building service industry (Article 1), and Article 11 (2) of the Enforcement Decree of the Act prescribes that an architect who meets the qualifications in subparagraph 1 of the same Article shall be given priority for receiving training for specialist in the building service industry or receiving support for starting up a building service business. Therefore, the regulations on the qualifications for persons eligible for support in laws legislated to support and promote the building service industry do not have to be interpreted in a strict and restrictive manner as administrative regulations that form the basis of administratively disadvantageous measures.

Also, when we look at how the term “government” is used in other laws, many laws use the term as encompassing local governments. For example, the title of an Article prescribing the policies of the State and local governments is stated as “Government Policies”. In this regard, it can be said that the scope of government is not limited to only government agencies and central administrative agencies.

In addition, Article 13 (4) of the Act prescribes that the State and local governments may limit the participation in the public competition with a view to promoting balanced development of the building service industry and creative design. But if it is assumed that only architects who won in a public competition hosted by the State, not local governments, are qualified to take part in public competitions, it will be contradictory to the legislative purpose of the law, which prescribes that local governments are also entities that are responsible for promoting balanced development of the building service industry and creative design. " -

"Yes, such parts are considered “arms” under Article 58 of the Enforcement Rules of the Aviation Business Act.

Pursuant to Article 58 of the Aviation Business Act and Article 100 (1) 2 of the Aviation Safety Act, no person shall transport munitions by operating flights using aircraft that has a foreign nationality which takes off from an airport in the Republic of Korea and lands outside the airspace of the Republic of Korea, while such transport is permitted where he or she has obtained permission from the Minister of Land, Infrastructure and Transport. Also, "munitions prescribed by Ordinance of the Ministry of Land, Infrastructure and Transport” under Article 58 of the Enforcement Rules of the Aviation Business Act is defined as arms and ammunitions, but there are no definitions on arms.

If so, the meaning of “arms” in the law should be interpreted based on the structure, purpose of the law and its related laws. And if “arms” is defined as an item with a similar purpose or nature, it should be interpreted that a similar level of restriction or management that applies to the item shall apply to arms as well.

In addition, under the Act on the Management of Military Supplies, which prescribes the basic matters and procedures related to the management of military supplies for their efficient and systematic management, it is prescribed that munitions shall be classified into war reserve items and conventional items (Article 3). And according to the Enforcement Decree of the same Act, war reserve items are combat equipment (including aircraft), combat support equipment, and auxiliary equipment necessary for their operations, repair parts and ammunitions, while munitions other than war reserve items are conventional items.

Also, the Directive on Management of Military Supplies (Ministry of Defense Directive no. 2322) classifies military supplies into types 1 through 10 according to their use and nature. Among those, type 7 (equipment) military supplies are sub-classified into firearms, special arms and aircraft. The main items under the category of aircraft are mission fighters, trainers, and repair equipment. In the subcategory of “aircraft” under type 9 (repair parts/tools) which prescribes repair parts for equipment, etc., the main items are aircraft equipment repair parts. Also, under attached Table 3 of the same Directive, which classifies military supplies according to their function, mission fighters, trainers and repair parts for such equipment are classified under the function of “aircraft”.

As such, the laws related to the management of military supplies classify aircraft as the same type as firearms or special weapons that can be considered wartime equipment and also prescribe that trainers and repair parts have the function of “aircraft”. Therefore, trainers used for the basic flight training of foreign air force student pilots and the parts used for such trainers are military supplies falling under type 7 and type 9 trainers and repair parts, and it shall be appropriate to consider them as “arms” banned from transportation using an aircraft with foreign nationality. " -

"“Obtaining authentication from a notary public in a foreign country” as prescribed by the proviso of Article 10-2 (1) of the Marriage Brokers Act means obtaining authentication from a notary public in a country other than the Republic of Korea.

Under Article 10-2 (1) of the Marriage Brokers Act, an international marriage broker shall obtain from the user that has entered into a marriage brokerage contract and the other party to marriage brokerage personal information such as: marriage history (subparagraph 1); health conditions (subparagraph 2); and occupation (subparagraph 3) and obtain the authentication of the notary public of each country concerned and provide the other party and the user the said information in writing (main sentence). In addition, the Article prescribes that the user or the other party who has obtained authentication from a notary public in a foreign country shall obtain confirmation from the consul in charge of notarization in accordance with Article 30 (1) of the Act on Notarial Acts Done at Diplomatic Missions Abroad (proviso).

A “foreign country” generally means countries other than the Republic of Korea. Also, the proviso of Article 10-2 (1) of the Marriage Brokerage Act does not state “countries other than the country concerned”, and the information listed in the subparagraphs of the Article are personal information such as marital history (subparagraph 1) and criminal records (subparagraph 4) that can be certified only through documents issued in the country of the nationality of the user or the other party to the marriage brokerage. Considering such facts, it is reasonable to consider that “foreign country” in the same Article refers to countries other than the Republic of Korea. If we suppose that “foreign country” is considered a country other than a country of the nationality of the user or other party to the marriage brokerage, the proviso of the said Article shall refer to obtaining an authentication from a notary public from a country other than the country concerned although the main sentence of the Article clearly states “notary public of each country concerned”. If so, the proviso of the Article shall be prescribing cases other than those prescribed in the main sentence, making it contradictory to the proper structure of main sentence and proviso.

In regard to the procedure for notarization of the personal information of the user or other party to the marriage brokerage, the regulation was newly inserted with the partial amendment of the Marriage Brokerage Act on Feb. 1, 2012. The regulation was newly inserted for the following purposes: to prevent marriages based on false personal information by having the information obtain authentication by a notary public considering that such information may be forged by an illegal international marriage broker and it is difficult to guarantee the authenticity of personal information in countries where such records are not properly managed; and to confirm that the information has been lawfully notarized by the diplomatic mission in the relevant country since each country has different notarization regulations.

Considering such purposes of the regulation, it is reasonable to conclude that the proviso of Article 10-2 (1) of the Marriage Brokerage Act stipulates that “the user or the other party who has obtained authentication from a notary public in a foreign country shall obtain confirmation from the consul in charge of notarization” to make it mandatory to obtain additional confirmation from the consul pursuant to Article 30 (1) of the Act on Notarial Acts Done at Diplomatic Missions Abroad even when the user and the other party obtained authentication from their respective countries, so that the damage that may be done to the user and the other party due to false information can be minimized considering the fact that international marriages heavily rely on information gained from the marriage broker. "