- Home

- Industries

- Industry News

- Industry Focus

Industry Focus

Market Size of the Korean Bio-Healthcare Industry

The total market size of the bio-healthcare industry in Korea is estimated to be about KRW 33.5 trillion as of 2016. This is the combined market size of the bio industry, pharmaceutical industry and medical device industry, which are major industrial sectors of bio-healthcare. Although some companies may be duplicated in the survey of each industry, the approximate overall size can be estimated. The bio industry consists of biomedical, biochemical and energy, bio food, bio environment, biomedical equipment devices, bio equipment and devices, bio resources and bio service sectors. The pharmaceutical industry includes compound drugs and biopharmaceuticals, whereas the medical device industry includes biotechnology-based medical devices and IT/machine-based medical devices.

By sector, in 2016, the biotech industry’s production reached KRW 88,775 billion, with KRW 44,456 billion in exports and KRW 14,606 billion in imports, amounting to a market size of KRW 58,925 billion. Increasing from KRW 55,281 billion in 2012 to KRW 58,925 billion in 2016, the compound annual growth rate (CAGR) stood at 1.6 percent. Although there has been no significant change in imports for the past five years, the market continued to grow with a steady increase in production and exports. As the proportion of imports remains low and the share of exports accounts for about 50 percent of total production, the market size is not so large.

Korea’s Biotechnology Industry

(KRW billion)

| 2012 | 2013 | 2014 | 2015 | 2016 | 5-Year CAGR | |

|---|---|---|---|---|---|---|

| Production | 71,445 | 75,108 | 76,070 | 85,039 | 88,775 | 5.6% |

| Export | 30,475 | 31,642 | 34,052 | 42,861 | 44,456 | 9.9% |

| Import | 14,311 | 13,872 | 14,006 | 14,087 | 14,606 | 0.5% |

| Market Size | 55,281 | 57,338 | 56,024 | 56,265 | 58,925 | 1.6% |

* Market Size= Production - Export + Import

* Source: Korea Biotechnology Industry Organization

In the pharmaceutical industry as of 2016, production reached KRW 188,061 billion, KRW 36,209 billion in exports, and KRW 65,404 billion in imports, marking the largest market share of KRW 217,256 billion. Up from KRW 192,266 billion in 2012 to KRW 217,256 billion in 2016, the CRGR stood at 3.1 percent. The market size has been steadily growing, thanks to the bigger increase in production and imports than in exports, and the share of exports is lower than those of the bio industry and the medical device industry.

Korea’s Pharmaceutical Industry

(KRW billion)

| 2012 | 2013 | 2014 | 2015 | 2016 | 5-Year CAGR | |

|---|---|---|---|---|---|---|

| Production | 157,140 | 163,761 | 164,194 | 169,696 | 188,061 | 4.6% |

| Export | 23,409 | 23,306 | 24,442 | 33,348 | 36,209 | 11.5% |

| Import | 58,535 | 52,789 | 54,952 | 56,016 | 65,404 | 2.8% |

| Market size | 192,266 | 193,244 | 194,704 | 192,364 | 217,256 | 3.1% |

* Market Size=Production - Export + Import

* Source: Korea Pharmaceutical and Bio-Pharma Manufacturers Association

Korea’s medical devices industry in 2016 posted KRW 56,031 billion worth of production, KRW 33,869 billion in exports and KRW 36,572 billion in imports, reaching a market size of KRW 58,734 billion. Rising from KRW 45,923 billion in 2012 to KRW 58,734 billion, the CAGR reached 6.3 percent. The industry saw a steady rise over the past 5 years. The share of exports compared to production was that highest among the three industries, but that of imports was also the highest.

Korea’s Medical Devices Industry

(KRW billion)

| 2012 | 2013 | 2014 | 2015 | 2016 | 5-Year CAGR | |

|---|---|---|---|---|---|---|

| Production | 38,774 | 42,242 | 46,048 | 50,016 | 56,031 | 9.6% |

| Export | 22,161 | 25,809 | 27,141 | 30,671 | 33,869 | 11.2% |

| Import | 29,310 | 29,882 | 31,291 | 33,312 | 36,572 | 5.7% |

| Market size | 45,923 | 46,315 | 50,198 | 52,657 | 58,734 | 6.3% |

* Market Size=Production - Export + Import

* Source: Korea Medical Devices Industry Association

Strengths and Prospects of the Korean Bio-Healthcare Industry

In Korea, the biopharmaceutical industry, in particular, is rapidly growing. According to the Export–Import Bank of Korea, the share of the biopharmaceutical market in the global pharmaceutical market is expected to increase from 19.9 percent in 2016 to 23.4 percent in 2021. Technology exports have recently jumped with the recognition of Korean companies’ technological prowess. Korea is particularly doing well in the biosimilar market. Celltrion Inc. is increasing its market share by introducing the world’s first monoclonal antibody biosimilar, Remsima, as well as other biosimilar including Truxima and Herzuma. Samsung Bioepis has launched four biosimilar in Europe, including Imraldi. The biopharmaceutical CMO market is also growing, the focusing on Celltrion Inc. and Samsung Biologics.

Major International Technology Transfers by Korean Companies in 2017

| Korean Company | Technology | Technology Acquired By | Tech Transfer Fee (USD) |

|---|---|---|---|

| Hanall Biopharma Co., Ltd. | HL161 | Roivant Science (Switzerland) | 503 million |

| KOLON LIFE SCIENCE Inc. | Invossa Inj. | Mitsubishi Tanabe (Japan) | 415 million |

| Genexine, Inc. | HyLeukin | I-Mab Biopharma (China) | 548 million |

Korea has secured the key requirements for the bio-healthcare to grow and is therefore expected to see continued growth in the future. First, with about 20 percent of the country’s R&D projects being made in the bio sector, much investment is put into the R&D of bio-healthcare. In addition, Korea boasts high-quality medical care to which bio-healthcare products and services are applied. The 5-year survival rate of Korean cancer patients, one of the indicators of health care levels, reached 68.1 percent, exceeding that of the USA (66.1 percent) and Japan (58.6 percent).

Korea is one of the countries that conduct global clinical trials most actively. According to the Korea National Enterprise for Clinical Trials (KoNECT), an analysis of clinical trial information registered with the National Institutes of Health clinical trial database ClinicalTrials.gov showed that Korea ranked sixth in global rankings with a market share of 3.5 percent of all pharmaceutical-led drug trials. Korea ranked sixth in national rankings with a 3.5 percent market share. In particular, Seoul, the capital city of South Korea, topped the list of cities where clinical trials were conducted the most. High-quality medical institutions and service networks, highly educated medical professionals, and the ease of recruiting subjects in the capital were likely to have contributed to the good results.

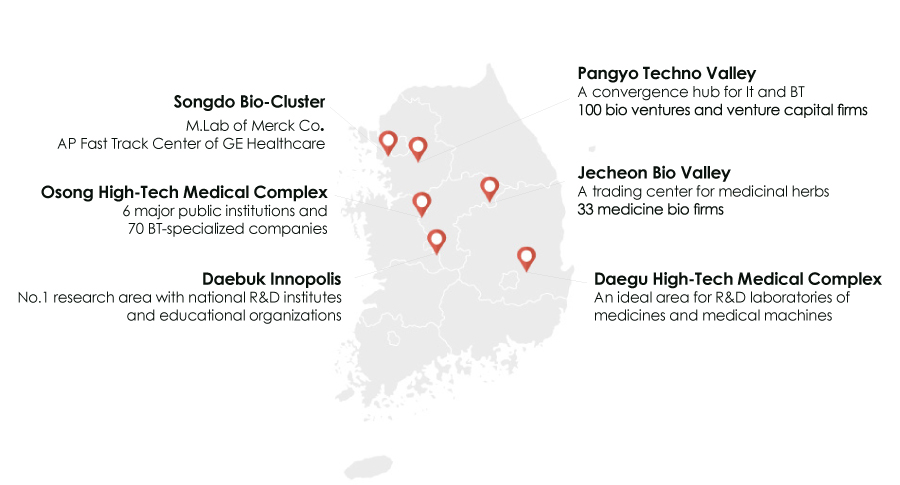

In addition, Korea has established specialized bio clusters nationwide. In the capital region, autonomous clusters, such as Songdo and Pangyo, are seeing rapid growth, whereas, in Osong and Daegu, the state-led High-Tech Medical Complexes are established and growing.

Korea’s Major Bio-Healthcare Industry Clusters

Above all, the future bio-healthcare industry is expected to develop in convergence with information and communications technology (ICT). Korea boasts high levels of ICT infrastructure and technology. According to the OECD Digital Economy Outlook 2017 published by the OECD Committee on Digital Economy Policy, the added value of Korea’s ICT sector exceeds 10 percent, which is the highest among OECD countries. The Korean government is currently working on various support policies and institutional improvements to foster new convergence industries such as health care IT.

Lastly, Korea has so far expanded its global market by focusing on North America and Europe, but it now seeks to diversify the market gradually into Asia and other regions. Asia is forecast to see a gradual increase in population and economic growth, and therefore, various cooperation opportunities will be available in not only tackling common issues such as an increase in chronic diseases and medical costs but also collaborative efforts to improve technology and infrastructure in the region.

[References]

Lee Min-ju. Analysis of Korea’s Bio-health Industry, Bio Economy Brief. Issue. 45. 2018.

Korea Biotechnology Industry Organization. Korea-ASEAN Economic Cooperation in the Bio-healthcare Sector. Ministry of Trade, Industry and Energy. 2018.

Jeehyun Kim, Senior Analyst

Korea Bio-Economy Research Center

Korea Biotechnology Industry Organization

jkim@koreabio.org

*The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA