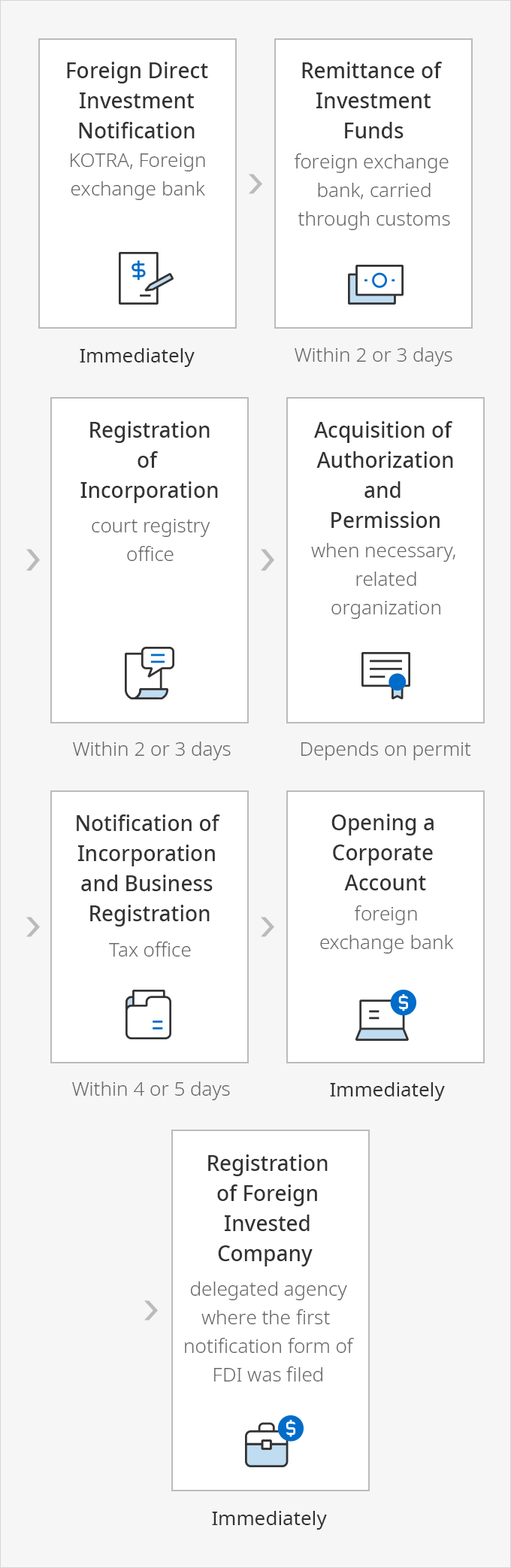

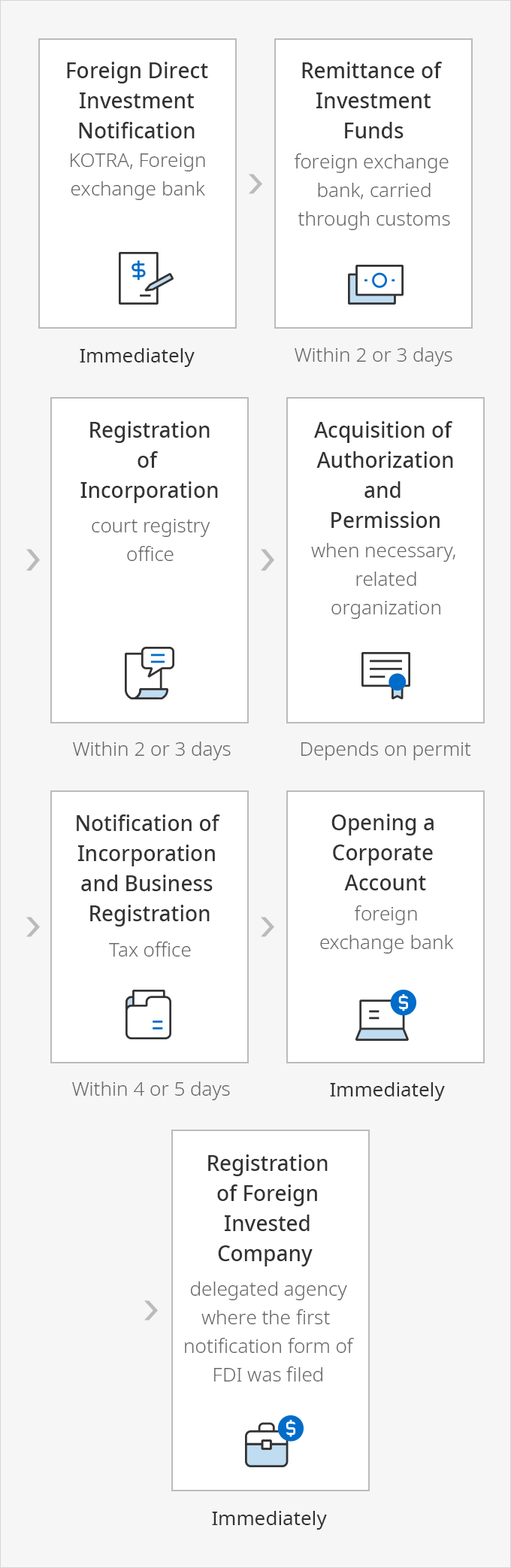

Foreign Direct Investment Flowchart

-

Foreign Direct Investment Notification

KOTRA, Foreign exchange bank(Immediately)

-

Remittance of Investment Funds

foreign exchange bank, carriedthrough customs(Within 2 or 3 days)

-

Registration of Incorporation

court registry office(Within 2 or 3 days)

-

Acquisition of Authorization and Permission

when necessary, related organization(Depends on permit )

-

Notification of

Incorporation

and Business

Registration

Tax office

(Within 4 or 5 days)

-

Opening a Corporate Account

foreign exchange bank(Immediately)

-

Registration ofForeign InvestedCompany

delegated agency where the first notification form of FDI was filed(Immediately)

※ Related laws: Articles 5 and 21 of the Foreign Investment Promotion Act, Articles 6 and 27 of the Enforcement Decree of the Act, Articles 2 and 17 of the Enforcement Rules of the Act.

Foreign Direct Investment Notification

A foreign investor is required to pre-notify the FDI to KOTRA (Foreign Investor Support Center in KOTRA headquarters or at overseas investment hub offices) or a foreign exchange bank.

REQUIREMENTS

Foreign Direct Investment Notification

In case of non-cash investments

※ Contact: KOTRA's Investment Consulting Center (1600-7119)

Evaluation of Technology

In order to invest with technology, the foreign investor should submit documents certifying the monetary value of industrial property rights, etc. Technology evaluation agencies are as follows: Korea Institute for Advancement of Technology, Korea Technology Finance Corporation, Korea Evaluation Institute of Industrial Technology, Korea Environment Corporation, Korean Agency for Technology and Standards, Korea Institute of Science and Technology, Korea Institute of Science and Technology Information, and National IT Industry Promotion Agency.

※ Article 30 (4) of the Foreign Investment Promotion Act, Article 39 (2) of the Enforcement Decree of the Act, and Article 4 of the Enforcement Decree of the Act on Special Measures for the Promotion of Venture Business

Remittance of Investment Funds

A foreign investor may remit investment funds by wire transfer to a temporary account at a domestic bank from overseas or hand-carry the foreign currency through customs directly. In the latter case, the investor should declare the funds at the customs office and receive a 'certificate of declaration of foreign currency'.

In principle, the remitted investment funds should undergo the procedure for deposit of funds for payment for shares and then a certificate of deposit of payment for shares is submitted to the court. However, in case of companies valued less than KRW 1 billion, it is possible to submit a certificate of balance after opening an account in the name of an investor. In this case, the funds can be freely withdrawn for business purposes from the following day.

※ Note: When reporting your foreign currency to the Customs, you must report it as "investment" or "investment fund" in the "Purpose of im/export" column, otherwise the funds will NOT be recognized as foreign direct investment.

Opening a Temporary Account

A foreign investor may open a temporary account after submitting documentary evidence of nationality (a certificate of existence of the foreign investor’s nation or a passport) to the bank. However, the required documents could differ depending on the financial institution. In addition, the remittance should be written in foreign currency and the purpose of the remittance should be stated ’investment.’

Registration of Incorporation

The registry division in the court accepts the application for the registration of incorporation and it takes two to three days for the registration. The required documents can be checked on the list of application forms and required documents from the Registry of Supreme Court Internet Register Office.

※ See Incorporation ▶ Incorporation procedure ▶ Registration of Incorporation

Authorization and Permission

Where deemed necessary for business, a foreign investor must acquire the authorization and permission from the competent authorities: District Office, Health Center, Ministry of Food and Drug Safety, etc. The processing period may vary depending on the sort of authorization and permission for the type of business.

※ See Incorporation ▶ Incorporation procedure ▶ Authorization and Permission

Notification of Incorporation and Business Registration

Every tax office accepts notification of incorporation and business registration regardless of the jurisdiction. It takes three days for the registration.

※ See Incorporation ▶ Incorporation procedure ▶ Notification of Incorporation and Business Registration

Opening a Corporate Bank Account

A foreign investor may open a corporate bank account at a foreign exchange bank immediately. However, the choice of bank requires careful consideration since opening additional accounts at another bank is restricted for twenty business days.

※ See Incorporation ▶ Incorporation procedure ▶ Opening a Corporate Bank Account

Registration of Foreign-invested Company

After the registration of incorporation, foreign-invested company registration shall be undertaken at KOTRA or at a foreign exchange bank where the notification was first made as the last step of FDI incorporation. The registration should be completed within sixty days following the payment of the object of investment.

REQUIREMENTS

Registration of Foreign-invested Company